For many years, there were so many questions and challenges to solve in the software development market. In 2026, there are only two: how will you win your next big client, and how much does it cost to outsource software development?

Did you notice that these questions are polar, as if they were asked by two different sides of the market: the provider and the client.

And you’ll be amazed by the one thing that unites these poles — rates.

Apart from cheap labor, the price delta between Western countries and Eastern Europe shows that it’s quite possible to find mature talent ecosystems that combine Western-level delivery standards with adequate pricing.

We can’t help admitting that founders are becoming more and more budget-conscious, and procurement teams size up cost matters more than anything else. Yet, the true value is in the right balance: hourly rates should match expertise, productivity, and working culture.

Below, we broke down offshore software development rates by country, compared mid-level and senior-level hourly costs, and explained why there is a difference.

Why Eastern Europe for IT outsourcing?

Time zone: A one- to two-hour difference from most EU clients. Obviously, this is the best possible option for offshore projects because of live collaboration. This leg-up has made the region a preferred choice for Germany, the Netherlands, the Nordic countries, and the UK.

US-based teams, on the other hand, have the morning overlap window (roughly 3-4 hours with the East Coast), which allows daily stand-ups and on-the-go communication. Pair this with autonomy, reliability, and lower cost, and you get a ready-for-users product without robbing your budget.

Engineering education: Historically, many post-USSR countries had a strong engineering and electronics tradition rooted in mathematics, physics, and computer science. The educational methods are disputable, but the generation of skilled engineers doesn’t let us lie.

Poland, Ukraine, and Romania together graduate 30-40K ICT students annually.

Several universities consistently rank among Europe’s top 400 for computer science. For example, Warsaw University of Technology (#173), the Politehnica University of Bucharest (#272), and Lviv Polytechnic National University.

Additionally, Poland and Romania have Google Developer and Microsoft R&D centers.

Google’s Warsaw Cloud Hub, opened in 2021, is part of a broader USD 3.3 billion European infrastructure investment; it employs hundreds of engineers working on global infrastructure reliability.

Similarly, UiPath, founded in Romania, grew into a USD 10B automation leader, serving over half of Fortune 500 companies. This is a good sign of the region’s potential.

High English proficiency: English-as-a-second-language is a common problem for collaboration across the world. Yet, Eastern Europe is one of the top non-native English regions. In the EF English Proficiency Index 2024, Poland (15th), Romania (12th), and Bulgaria (16th) all scored within the high proficiency band — ahead of France, Spain, or Italy.

Commitment and overdelivery: Ukraine is especially outstanding in this case — Ukrainian devs underpromise since they can’t afford to risk their reputation (they might be bombed any time), but eventually, often overdeliver. And there is no country that can match the amount of effort to ensure power resilience.

The average fixed broadband speed is about 80 to 100 Mbps. Data-center capacity in Warsaw and Bucharest has doubled since 2020.

Despite Russian aggression, Ukraine’s IT companies have delivered 95% of signed deals throughout 2023-24 (remember about redundant power and Starlink adoption).

Reasonable cost-quality ratio: Offshore software development rates across Eastern Europe in 2025 range from USD 30 to USD 70 for mid- to senior-level engineers, depending on specialization and location. This is half of Western Europe’s tags and 50-70 % below the US, and still offers robust technical expertise.

This explains why Microsoft, Siemens, and other global enterprises are scaling delivery hubs across Poland, Romania, and Bulgaria — seems like a consistent, long-term engineering investment.

2026 developer rates by country

You won’t be surprised that current offshore developer rates don’t only depend on location and the cost of living there. They depend on the demand volume and specific skillset way more.

That’s why some rates can match those in Silicon Valley, as ML infra, cloud reliability, blockchain security — these industries and related skills are gaining momentum.

This sharp bifurcation shows the premium rewards for deep stack mastery in the region — and why understanding regional rate bands is critical before starting vendor conversations.

Below, you’ll find country-by-country breakdowns of typical junior, mid-level, and senior rates, popular tech stacks, differences between freelancers vs agencies, and key cost considerations.

Poland

Interestingly, senior roles are taking over Poland’s labor market — 52.3% of new listings are for senior specialists, while juniors account for 5.9%. Despite the decrease in AI hype, the demand is still strong in AI/ML and Data; DevOps, and backend engineering are also sought-after.

Average hourly rates

Junior (0-2 years): USD 20-30/hour

Senior (6+ years or specialized roles): USD 65-90/hour

Popular tech stacks

Cloud/DevOps: AWS, Azure, GCP, Kubernetes, Docker

Freelancer vs. outsourcing company rates

Freelancers (contract/B2B): Usually, near the upper end of mid-range when remote and full-stack; for senior roles with specialized infrastructure or AI/ML, freelancers can match or even exceed company rates (many such specialists have enough experience and switch to fractional model).

Outsourcing/agency companies: Have higher rates for senior/specialized roles (to be completely honest, for juniors too) because of their complex approach, with QA, project management, infrastructure, and risk margin.

Influencing factors

City: Warsaw and Krakow have higher rates than smaller cities like Lublin. And there is an assumption that these examples will bring about rising costs in smaller cities as well. Not as high, though.

Specialization: AI/ML, Cloud-native, DevOps, and Security will cost ~15-25% above baseline.

Company size: Large companies offer more consistent benefits and salaries, and small shops offer lower above-market rates but more personalized attention.

Seniority: Not years but leadership, architecture experience, crisis/risk forecasting, and domain specialization.

Up or down in popularity?

Poland is trending up: +68% more job postings than in 2024. Seniors are growing and demand for AI/Data roles is gaining ground. Costs are increasing, so are foreign investments in local R&D offices.

Hire software developers in Poland

Romania

Probably, the most rapidly growing black horse in this market. Stable and business-friendly destination with an appropriate level of regulatory adherence and tenable cost of offshore software development. The country’s ICT service exports were about USD 11 billion in 2024, growing at about 12% YoY.

Average hourly rates

Junior (0-2 years): USD 20-25/hour

Mid-level (3-5 years): USD 25-45/hour

Senior (6+ years or specialized roles): USD 45-75/hour

Popular tech stacks

JavaScript (React, Node.js), Python, Java, .NET, and PHP dominate, but there’s strong traction in AI, cybersecurity, and embedded software — especially among teams serving automotive and defense industries.

By the way, Cluj-Napoca and Bucharest host R&D centers of Bosch, Siemens, and IBM.

Freelancer vs. outsourcing company rates

In Romania, the picture is similar to the worldwide one: locally known fractional IT leaders and business-oriented freelancers charge at a level of small devshops. Average part-time or project-oriented specialists have offshore software development rates of 10-20% less than established companies.

Yet, the gap is narrowing as more independent engineers join structured collectives or micro-agencies that offer contract reliability, insurance, and NDAs for Western clients.

Influencing factors

Rates in Cluj and Bucharest trend roughly 15% higher than in Timisoara or Brasov. Specialized skills in AIOps, DevSecOps, and AR/VR also push costs upward.

Larger vendors (250+ engineers) add a 5-10% markup for project management and ISO compliance.

Up or down in popularity?

Romania’s EU membership, strong English proficiency (ranks #12 globally in EF EPI 2024), and reliable internet infrastructure make it a go-to destination. Its outsourcing ecosystem matured fast after 2020, and now attracts nearshoring projects from Germany, the Netherlands, and the UK.

Hire software developers in Romania

Ukraine

Throughout the last 4 years, Ukraine’s IT industry has demonstrated remarkable resilience. ICT export decreased by 4.4% but still exceeded USD 6 billion in 2024. You can choose from more than 238K developers with problem-solving skills, a Western work ethic, and expertise in popular fields: Fintech, AI/ML, cybersecurity, and healthtech.

Average hourly rates

Senior and specialized: USD 35-70/hour

Popular tech stacks

Frontend: React, Angular, Vue.js

Backend: Node.js, .NET, Java, Python, PHP

Cloud and DevOps: AWS, Azure, GCP, Docker, Kubernetes

QA and Automation: Cypress, Selenium, Playwright

Freelancer vs. outsourcing company rates

The freelancer market in Ukraine isn’t that mature. Since the market is relatively small, reputation makes the difference — the most effective promotion is word of mouth.

This determines lower rates for freelancers who are not widely known. Outsourcing companies offer added value: they take over project management, quality control, and compliance readiness.

Many mid-sized Ukrainian companies also work as long-term delivery partners for Western tech organizations and offer dedicated development teams with strong retention and institutional knowledge.

Influencing factors

You won’t be surprised — location plays a huge role here (Kyiv, Lviv, and Ivano-Frankivsk being pricier), as well as domain specialization (AI, fintech, and cybersecurity at the top end).

Company size is also important, with their authority and reputation as cornerstones (and ISO/SOC certifications).

Note: Cross-functional teams that include DevOps, automation QAs, and architects can push project rates above USD 70/hour.

Up or down in popularity?

It depends. Geopolitical risks remain, but phenomenally, Ukraine’s outsourcing industry continues to expand. The local techies won client loyalty and continue to develop government-backed digital infrastructure (e.g., Diia City, Defense City, and e-residency initiatives). Western companies increasingly see Ukraine as a strategic partner for complex software development.

Hire software developers in Ukraine

Bulgaria

Hardly can you find a more underrated country in Eastern Europe in terms of the cost of offshore software development. The country has a stable economy, deep specialization in fintech and enterprise-grade software, and is an EU member. The ICT sector contributes over 2% of the county’s GDP, employing more than 115,000 tech professionals.

Sofia and Plovdiv remain the two biggest outsourcing hubs. Varna and Burgas are rapidly growing.

Average hourly rates

Mid-level: USD 30-45/hour

Senior and deep specialists: USD 50-80+/hour

Popular tech stacks

Backend: Java, .NET, Python, PHP

Frontend: React, Angular, Vue.js

Mobile: Flutter, Kotlin, Swift

Data and Cloud: AWS, Azure, Snowflake, Docker, Kubernetes

Emerging: Blockchain, AI/ML

Freelancer vs. outsourcing company rates

Predictably, freelancers in Bulgaria follow a worldwide principle — they have smaller offshore rates for software development. Let’s say, 20-40% less than established devshops.

Larger delivery centers, particularly in Sofia and Varna, offer mature delivery management, ISO-certified processes, and bilingual project coordination. The country’s EU alignment also ensures easier data compliance under GDPR and standardized contracts.

This means that such an upfront investment pays off after release.

Influencing factors

Here, we see the same influencing factors: location, niche specialization, and English proficiency, paired with the working culture.

These facets can raise the price tag up to USD 90/hour; this is especially noticeable in cooperation with larger firms with strong governance, because they guarantee enterprise reliability.

Up or down in popularity?

Also up. EU membership, a relatively stable political situation, competitive costs, and proven delivery maturity. Additionally, Bulgaria allocated EUR 51.2 million to support their Industry 4.0 concept, boosting automation, data analytics, AI, and smart manufacturing.

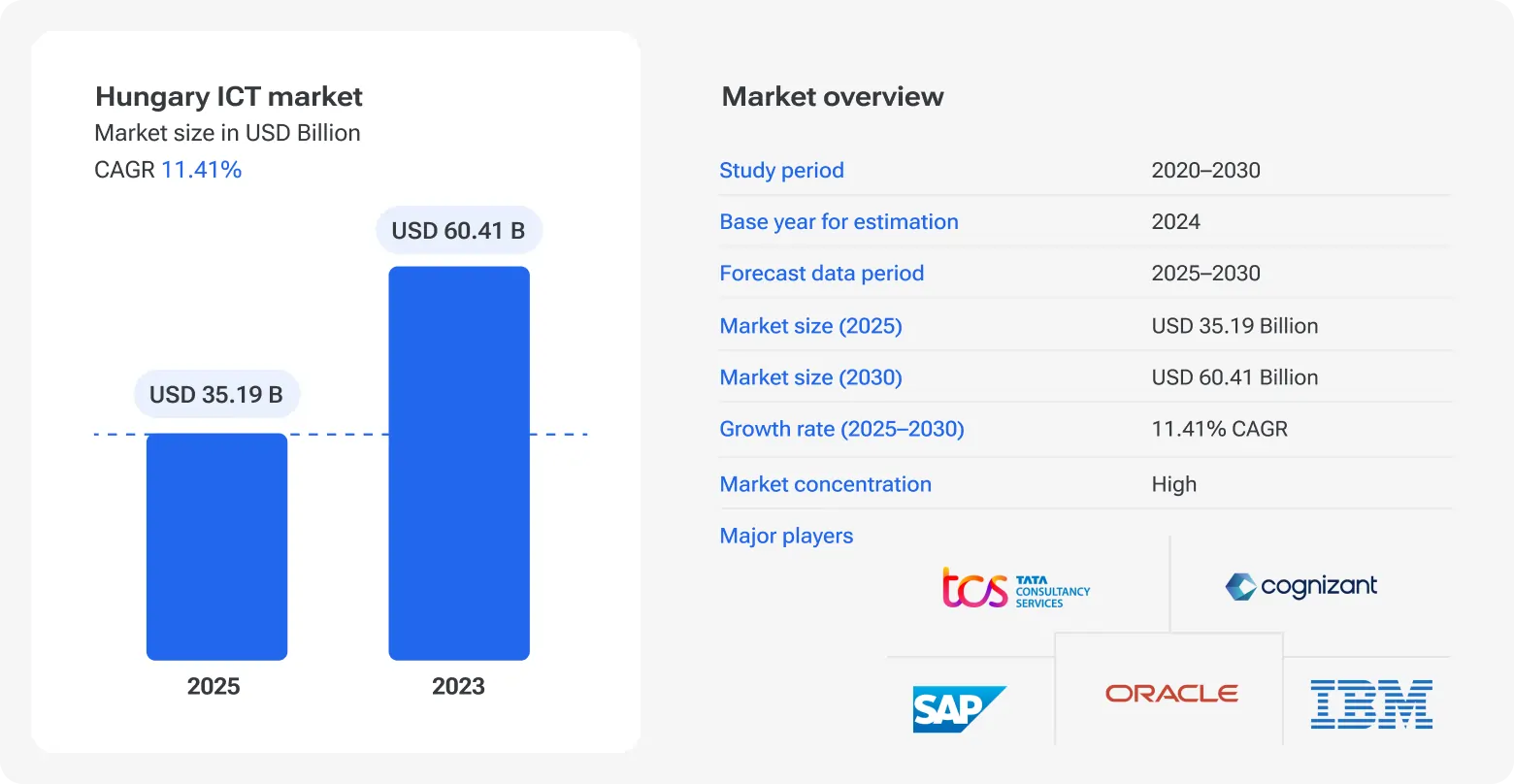

Hungary

Hungary’s ICT market was USD 35.19 billion in 2024, and Mordor Intelligence thinks it’ll grow at 11.41% CAGR (with special attention to new R&D centers in Budapest and regional hubs). Up front, we should note that Hungary’s political position will definitely influence its success on the international tech market, and the thing is that it depends mostly not on the country.

So, how much does it cost to outsource software development here? At least at the moment.

Average hourly rates

Mid-level: USD 25-35/hour.

This was calculated based on the average monthly salaries in the main hubs, like Budapest.

Popular tech stacks

Backend: Java, .NET, Python, Node.js

Frontend: React, Angular, Vue.js

Cloud and infrastructure: AWS, Azure, Kubernetes, Docker

Data/AI: Python, TensorFlow/PyTorch, data-engineering stacks

Freelancer vs. outsourcing company rates

Freelancers: typically 10-20% lower for routine work but can match company rates for specialized consulting (let’s say, data science, which is probably the most in-demand niche now).

Outsourcing companies charge more because of managed delivery (PM, QA, SRE), compliance, and determined SLAs. 15-30% uplift versus freelancer rates for the same seniority.

Influencing factors

City (surprise!): Budapest with the highest rates (multinationals and VC-funded scaleups contribute to this). Debrecen, Szeged, and Pecs are cheaper.

Specialization: AI/ML, SRE, and embedded systems. This is a remarkable trend worldwide, so expect a +20-40% premium if you need niche skills.

Seniority: Proven architects and delivery leads can more than double mid-level rates, but the end value is not clear sometimes.

Up or down in popularity?

Mixed, to be completely honest. Hungary’s tech market shows growth, but this is based more on intuition and predictions. As we all have seen, not all predictions and forecasts come true.

At the same time, geopolitical and fiscal pressures warn international behemoths to think twice before long multi-year commitments. Buyers should treat Hungary as a mid-value, mid-risk destination with frugal offshore development rates.

Czech Republic

About 200,000 tech professionals in the tech industry and over 27,000 ICT graduates annually make the Czech Republic one of the most promising and robust destinations in Central Europe. Oracle, IBM, and Red Hat have invested in the country’s economy, and 46% of enterprises use a fast Internet connection (exceeding 100 Mbit/s).

Average hourly rates

Mid-level: USD 40-65/hour

Popular tech stacks

Backend: Java, .NET, Python, PHP, Golang

Frontend: React, Angular, Vue.js

DevOps and Cloud: AWS, Azure, Docker, Kubernetes, Terraform

Data and AI: Python, Spark, Hadoop, TensorFlow

Specialized domains: Automotive software, cybersecurity, fintech, and industrial automation

Freelancer vs. outsourcing company rates

15-25% less for freelancers (around USD 35-55/hour for mid-level engineers), and more for outsourcing companies. But as usual, you can expect an end-to-end delivery with QA, project management, and infrastructure.

Influencing factors

City: Prague and Brno are the main tech hubs. Prague has a bit more skilled talent for corporate and fintech projects. Brno is known for embedded and industrial software.

Specialization: AI, cybersecurity, and IoT engineers.

Company size: Larger consultancies maintain strict delivery processes and ISO 27001 and GDPR compliance.

Seniority: Don’t be surprised, but senior architects can command USD 120+/hour.

Up or down in popularity?

Stable. The Czech Republic attracts complex outsourcing projects (especially in automotive software and industrial automation). A more stable economy, geopolitical situation, and EU membership look like a “safe bet” for Western clients.

Yet, note the limited developer availability. Domestic tech startups and R&D hubs make talent acquisition challenging, with their more delectable compensation.

Hire software developers in Czech Republic

Moldova

One more contender for Eastern Europe’s fastest-growing destinations, with the strongest advantage — offshore software development cost. Not the biggest talent pool (about 32,000 techies), but lower taxes (12% corporate income tax) and stable exports — USD 512 million in 2022.

Don’t rush to judge the book, Moldova punches far above its weight. Here’s why.

Average hourly rates

Mid-level: USD 30-45/hour

We calculated this as an average from the monthly salary median.

Popular tech stacks

Backend: Java, .NET, PHP, Node.js

Frontend: React, Angular, Vue.js

Mobile: Flutter, Kotlin, Swift

Cloud and DevOps: AWS, Azure, Docker, Jenkins

Niche expertise: Blockchain (including DeFi), AI integration for small-scale automation, and ERP systems

Freelancer vs. outsourcing company rates

We can equate the local freelance culture with the Romanian one. Self-employed specialists make less than structured outsourcing companies.

The country’s most successful software exports come from well-organized delivery centers, which operate large engineering teams for Western European and North American clients.

These companies have ISO 27001-certified infrastructures and handle complex multi-year contracts.

Influencing factors

City: Chisinau dominates, with nearly 80% of all IT exports. Balti and Tiraspol host emerging regional tech centers but mainly focus on support and QA services.

Specialization: Fintech developers, QA automation engineers, and DevOps experts.

Track record: Since this is a less-known destination, openly shown cases weigh more than in the US, for example.

Up or down in popularity?

Moldova is similar to Romania, with a similar work culture and growing recognition in Western markets. The government’s Moldova IT Park initiative offers a single 7% tax rate for IT companies.

So, we’d say the destination may grow up, but not that rapidly. Because we should always remember the pressure from Russia.

Slovakia

The Slovak software development industry is relatively smaller than in neighboring countries, but it’s one of the most promising in Eastern Europe, considering the delivered quality and offshore rates for software development.

The country is the best in ICT adoption in the Visegrad group countries and ranked #29 among Europe’s economies in the 2024 Global Innovation Index.

Average hourly rates

Mid-level: USD 40-50/hour

We calculated this as an average from the monthly salary median.

Popular tech stacks

Backend: Java, .NET, Python, and Golang

Frontend: Angular, React, Vue.js

Mobile: Kotlin, Swift, Flutter

Data and Cloud: AWS, Azure, TensorFlow, Kubernetes

Niche expertise: Embedded systems, industrial IoT, and AI for manufacturing

Freelancer vs. outsourcing company rates

Here, we see the standard situation, where mid-level independent developers make USD 35-50/hour, a bit less than established outsourcing teams.

Yet, the notable feature is that the gap between B2B delivery and freelancer popularity is wider, as Slovakia’s IT companies made their names on strong compliance frameworks and ISO-certified environments.

Influencing factors

Cities: Bratislava and Kosice are the two major tech centers for multinational delivery centers (IBM, Accenture, Dell) and startups.

Specialization: Developers in fintech, embedded software, and AI often work on EU-funded R&D programs and may charge more.

Company size: Companies with 250+ specialists partner with Western EU clients in banking, logistics, and e-mobility sectors. Smaller boutiques cater to startups in SaaS and MedTech.

Up or down in popularity?

Trending steadily up. Slovakia isn’t a low-cost outsourcing market anymore, but it’s increasingly valued for high-trust partnerships, low attrition, and EU-grade compliance.

The ICT is growing ~8% YoY despite talent competition from Austria and Germany.

The government’s Digital Slovakia 2030 initiative continues to fund AI and cybersecurity research, and universities ensure a stable flow of young, skilled engineers (as of 2023, the sector has created 87,000+ jobs, and the total number of ICT employees has grown by 70% since 2016).

Hire software developers in Slovakia

Comparative table

We can show offshore software development rates by country, but demonstrating a total value is a more challenging task. It requires a deeper dive into the country’s context and your project requirements. Yet, this is still a good baby step.

Country

Junior Dev (USD/hr)

Mid-level (USD/hr)

Senior Dev (USD/hr)

Notes/Specialty

Highly mature market. A go-to choice for AI/ML, DevOps, Data, and backend engineering. Senior roles dominate, with 52.3% of employment.

Key strengths are cybersecurity, embedded software, and automotive R&D.

Resilient and mature outsourcing sector. Deep expertise and successful track record in Fintech, AI/ML, cybersecurity, and healthtech.

Fintech and enterprise software focus. Sofia and Varna lead as specific locations.

Budapest is the main hub, but political risk moderates attractiveness.

Innovation-driven ecosystem with IoT and automotive software as the leading directions.

Cost-efficient, smaller market with specialization in blockchain, fintech, and QA automation. Moldova IT Park offers 7% tax rate.

An ideal choice for projects related to embedded systems and industrial IoT.

Key trends to watch in 2026

Rates are rising in mature markets. Poland and the Czech Republic are entering a higher-cost phase as demand for senior engineers and R&D roles grows.

Ukraine’s resilience and continued relevance. Obviously, the war makes adjustments, but Ukraine remains a robust delivery partner and – which is more important – Europe’s only tutor in building real business continuity and energy independence.

Niche tech = bigger tag. AI, blockchain, DevOps, and cybersecurity roles are above baseline rates worldwide, not just in the observed region. Specialized skill sets affect pricing more than location.

Talent migration restructures markets. The most notable is the seniors’ migration from Ukraine and Belarus to Poland, Romania, and Slovakia, and this continues to impact local cost and availability.

Hybrid delivery models are rising. The future of software development outsourcing is a combination of local proximity and nearshore scalability. Project management in Germany + delivery teams in Romania or Ukraine. A go-to model for balance, cost, and agility.

Conclusion

It’s quite naive to think that cheap can be A-class. Not in 2026. We can’t dictate to you since we have no cards, but please think of your service or product first. Can you deliver a top-of-class performance with no budget… constantly?

The same with the software development — the total value makes the game.

Team’s delivery, whether they fit your working vibe, whether they meet your quality standards at all.

Also, scalability, IP protection, and long-term collaboration potential. If all these points hint at higher offshore development rates, niche expertise, and maturity — maybe they can also bring better ROI.

For more than 16 years, Devico has been helping tech leaders find the perfect balance between quality, speed, and cost.

Feel free to schedule a meeting with us to discuss rates across countries and create a transparent cost map designed to your needs.

Motivated and focused experts for up to 60% less than locals, delivered in days, not months