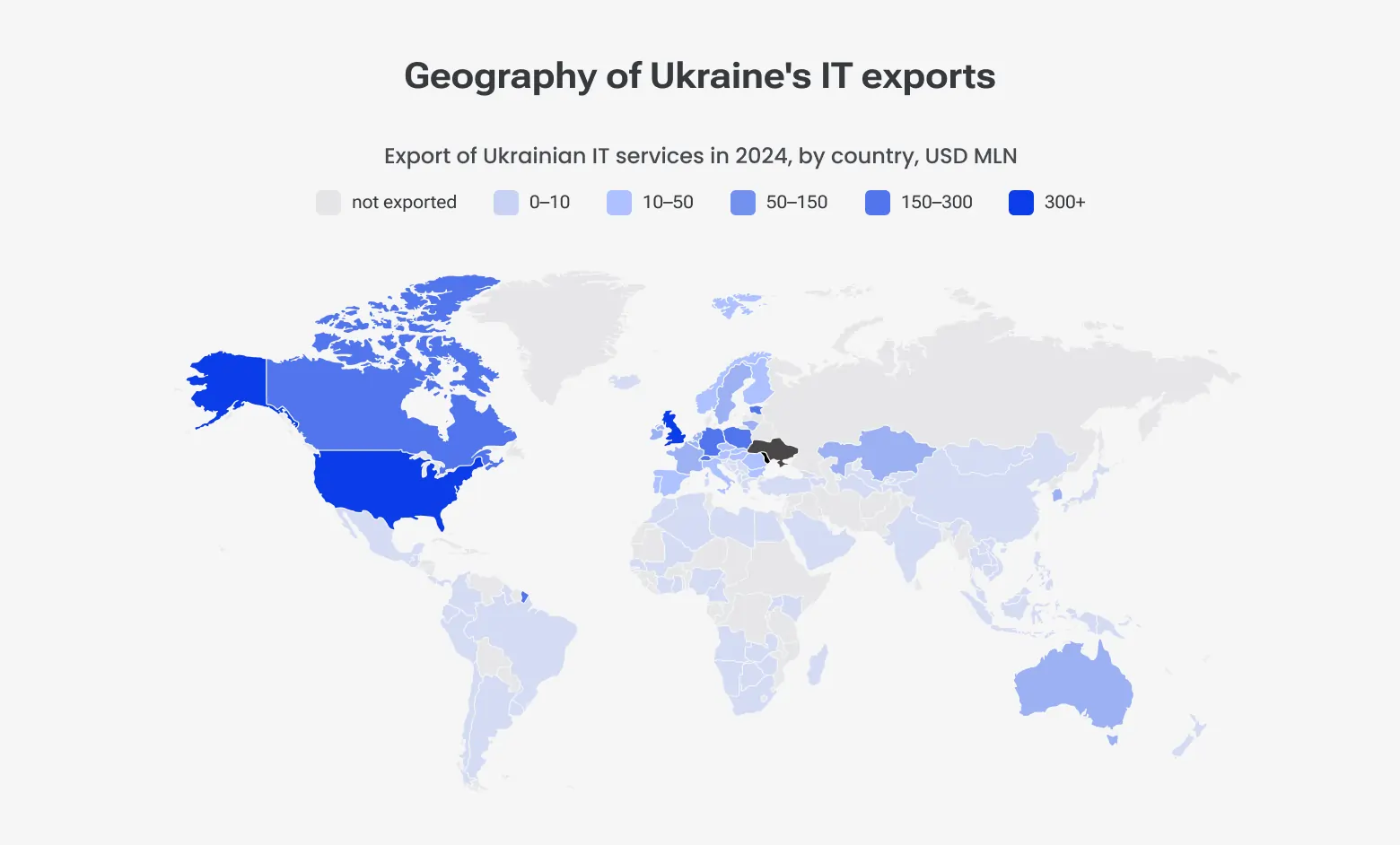

India and Ukraine both rank among the world’s leading IT exporters. According to several sources, Ukraine generated from USD 6.2B to USD 6.4B in IT services exports in 2024. Since 2019, Ukraine’s IT outsourcing has grown by 54.5%.

Ukraine’s outsourcing companies have a back belt in resilience and quality-driven surge — Ukrainian devs deliver despite war, blackouts, and economic hurdles.

But this doesn’t mean that India doesn’t have its advantages.

This means that India vs. Ukraine software development outsourcing has nuances:

-

Talent scale and specialisation: India’s 5.4 million IT professionals (2023) and USD 194 billion in export revenue vs Ukraine’s ~300,000 specialists and USD 6-7 billion exports, but higher per-capita technical quality.

-

Cost versus quality: how pricing varies depending on tech stacks and engagement models.

-

Speed and stability: comparison of hiring cycles, infrastructure resilience, and vendor ecosystems.

-

Communication fit: English proficiency, cultural compatibility, timezone, and legal frameworks.

So, which country aligns best with your business priorities?

Devico helps you answer this question objectively – keep reading or book a free meeting.

Flexible staff augmentation and expert software developers in Ukraine

IT market overview: India vs. Ukraine

While both India and Ukraine play major roles in the global software development outsourcing services landscape, their markets operate on different scales and models.

Market size and growth

India: The IT‑BPM industry reached USD 253.9 billion in FY 2024, and a monthly number of hired techies reached 3.3 K (overall headcount is 5.4 M). India achieved USD 194 billion in exports and domestic revenue at USD 51 billion (~7.4% of GDP).

Ukraine: IT services exports reached USD 6.4 billion in 2024. Despite a slight decline of 4.2% from the previous year, it contributed around 38% of all services exports.

The absolute figures of IT outsourcing India vs. Ukraine are on India’s side, but Ukraine’s industry has grown ~195 % between 2017 and 2022 (India grew by about 84 % in the same period).

So what: India shows greater scale, but Ukraine is growing much faster.

Developer population and quality

India: 5.4 million IT/BPM employees; rapid expansion being driven by NCC and GCC investments.

Ukraine: 300,000+ techies: 275K working domestically, 30K+ working abroad; average age 30 years with a little increase for higher tech roles (CTO and similar roles have an average age of 32 years).

When measured by per-developer export contribution, Ukraine outpaces India by a wide margin: a result of fewer but more specialised and productivity‑focused talents.

So what: India offers volume and capacity; Ukraine delivers concentrated technical depth and efficiency.

Key technologies and industry verticals

India: Wide client base. Many famous enterprises choose India for IT outsourcing for banking and financial services (BFSI), healthcare tech, e‑commerce platforms, and global capability centres (GCCs). Generative AI and cloud modernisation adoption gains ground: +15% available to hire AI/ML engineers roles in 2024.

Ukraine: Has a knack for fintech, cybersecurity, embedded systems, and blockchain. Deepening its expertise in deep AI and machine learning. Lviv and Kyiv host over 1,000 R&D centres, including global players like Samsung, Ericsson, and EPAM.

So what: India offers scale across mainstream domains; Ukraine delivers niche, high-complexity projects.

Major outsourcing hubs

India: Bengaluru is the center of IT outsourcing in India. We can also single out New Delhi NCR, Mumbai, Hyderabad, and Chennai. These cities host international delivery centers and hubs for dedicated R&D services.

Ukraine: Ukraine’s IT outsourcing is concentrated in Kyiv, Lviv, Dnipro, and Kharkiv. Each city has modern infrastructure (cloud-first, backup power) and mature vendor networks.

So what: India’s hubs are larger; Ukraine’s hubs offer quality talent clusters and operational resilience even during disruptions.

Cost comparison: Which country offers better value?

With staff augmentation, value isn’t just about paying less, it’s about what you get for the cost. Factors like code quality, communication, time-to-delivery, and team stability all play a role. While some countries may offer lower hourly rates, others deliver more in terms of reliability and overall project success.

Average hourly developer rates

Rates are influenced by tech stack, region, and engagement model. Remote work and vendor support structures also affect pricing.

Engagement models: When calculating offshore development costs in India and Ukraine, expect companies to bundle infrastructure, project management, and HR into hourly rates. You might say freelancers are cheaper. That’s right, but with varying reliability.

What are the costs of hiring software developers in Ukraine?

Hidden costs to consider

Time‑zone alignment: Ukraine’s UTC+2/3 (the country switches time) overlaps better with the EU and the US East Coast than India’s +5.5.

Cultural training: Ukrainian teams are European-oriented and perfectly navigate Western Agile and DevOps practices. They went through all stages: from the cascade model to the modern ones.

Infrastructure readiness: Ukrainian hubs (especially in Kyiv and Lviv) already have severe backup infrastructure, including local power stations and cloud redundancy.

Tax and legal frameworks: Diia City regime (Ukraine) offers two main tax options: Exit Capital Tax (9% on the withdrawal of dividends), and Income Tax (18% of the company’s total profit). Also, there are significant incentives for labor taxation rates. At the same time, India’s incentives are tied to GCC structures and SEZ setups.

Where the balance is

IT outsourcing to India often brings lower average rates, but also has some implications of quality. A mid-level full-stack developer at USD 20/hr may require management and validation. Chances are, he will have communication difficulties and process misalignment. In indirect terms, you double the overall project cost.

Ukraine offers balanced ROI: Yes, hourly rates may be slightly higher (remember about specialized skills), but clients get faster delivery, stronger domain understanding, and lower overhead in management and infrastructure setup.

Can you count on local talent?

In IT outsourcing, the quality of local talent can make or break a project. A reliable talent pool often reflects the region’s investment in education and its alignment with modern development practices.

Education level and the popular associated skills

There are several world’s top engineering institutions in India (the IITs and NITs). In 2025, the top 3 universities from India look like this:

-

IIT Delhi: 171st globally

-

IIT Kharagpur: 202nd globally

-

IIT Bombay: 234th globally

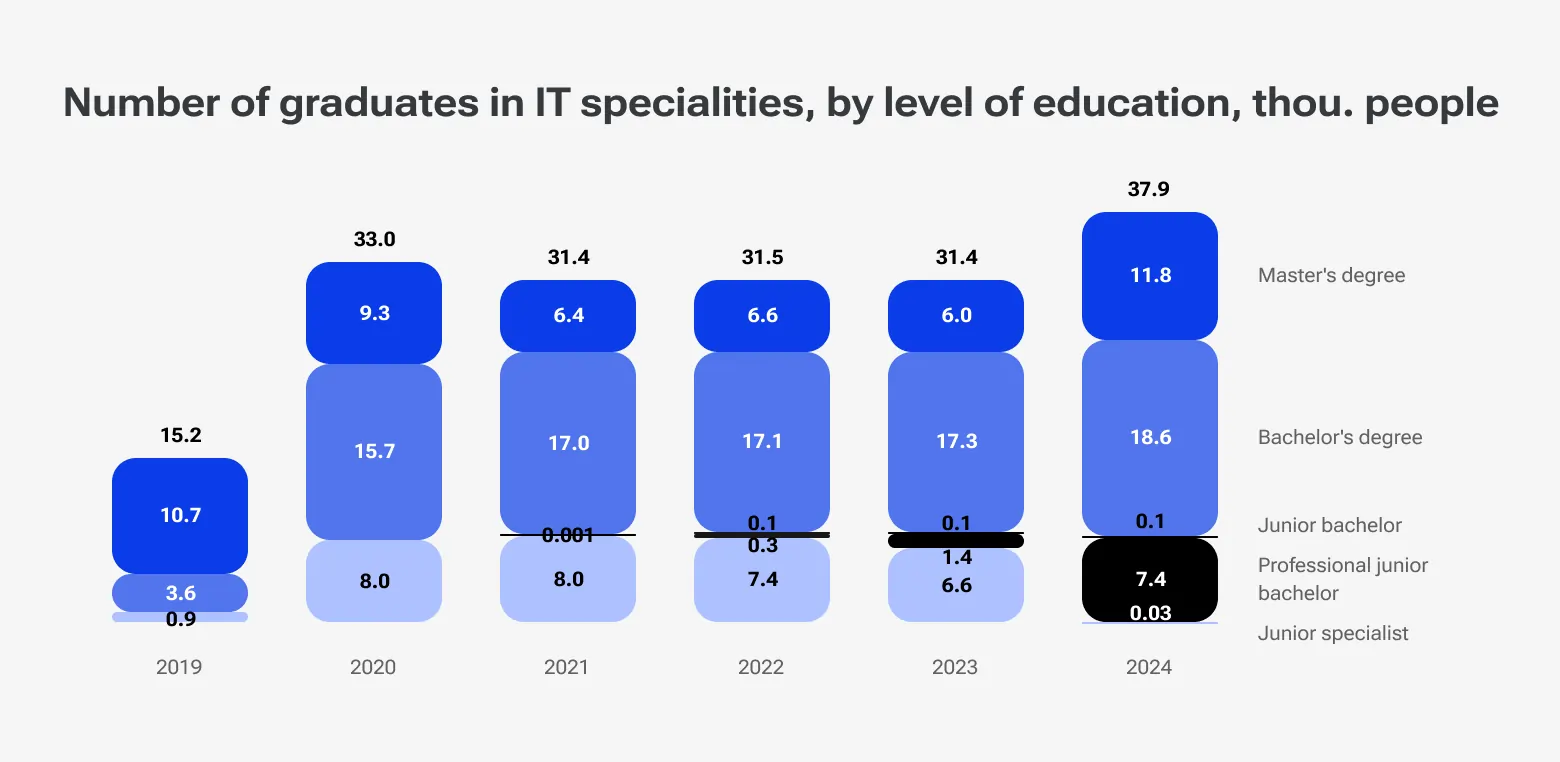

Ukraine’s best tech universities (Kyiv Polytechnic Institute, Taras Shevchenko National University, and Ukrainian Catholic University) enter several world-renowned lists. Ukraine produced 37.9K IT graduates in 2024. Over the past 6 years, this number has doubled.

So what: Again, India delivers sheer output. And Ukraine’s outsourcing companies employ graduates in niche disciplines like cybersecurity, embedded systems, and, more recently, AI.

English proficiency

Ukraine sits in the 40th position out of 116 on the EF English Proficiency Index with a score of 535 (global average: 477).

India does not feature in the top “high” proficiency band — 69th place.

So what: Ukrainian teams generally better understand your goals, needs, and tech stack needed due to overall better fluency. This reduces onboarding time and, eventually, saves money.

Work ethic and culture

Ukrainian engineering culture is based on Western‑style agile methodologies: the lion’s share of outsourcing services companies work in Agile/Scrum and DevOps frameworks.

There are no studies or surveys on models or outlooks on IT outsourcing in India, but speaking from experience, clients say Indian teams have lower alignment with Western business norms.

On the other hand, if you want to hire a dedicated development team from Ukraine, it often integrates with your team within 1-3 weeks.

So what: Ukraine offers a faster path to productive collaboration with Western stakeholders.

Business and political stability

Business-friendly policies, legal transparency, and consistent governance create a safer environment for long-term partnerships. Even in attractive markets, political hazards such as regulatory changes, geopolitical tensions, or shifting economic policies can introduce hidden risks.

Political hazards

Modern wars are the main risk. Russia’s aggression in Ukraine and the India-Pakistan conflict shake stability and decrease the investment climate in regions. Yet, outsourcing in Ukraine relies on an excellent media campaign by the Ukrainian government.

In 2023, Ukraine had a -1.4 score according to DataBank, while India had -0.6. After two years, the situation probably got worse, but still, many international companies operate in Ukraine.

We can’t help but mention India’s recent cross-border tension with Pakistan. As of December 2025, the ceasefire holds, but no one feels safe due to cybersecurity threats and physical danger.

So what: Both countries bring geopolitical risks. Ukraine’s infrastructure resilience and active recovery planning stand in contrast to India’s ongoing regional friction and regulatory volatility.

Economic considerations for potential clients

Ukraine is supposed to receive EUR 1.5 billion in investment from EBRD throughout 2025. Among other sectors, this will help to strengthen the tech industry. This should bring about 5 % GDP growth next year if hostilities subside.

As the main competitor of outsourcing to Ukraine, Bengaluru, Hyderabad, and Mumbai host centers from Microsoft, Google, and Amazon.

So what: Comparing IT outsourcing India vs. Ukraine, you should scan the media space and consider private consultations. Ukraine shows growing investor confidence, even though an active phase of the war continues. India is forced to navigate regulatory uncertainties and cybersecurity concerns.

Data protection and IP

Ukraine doesn’t adhere to the General Data Protection Regulation, which is the EU’s general standard. But the country aligns with the "Law on Personal Data Protection" and de facto ensures legal harmonisation with EU norms. Vendors include GDPR compliance, NDAs, and data transfer agreements in their contracts.

India has its IT Act 2000 and updated rules under the Digital Personal Data Protection Act (DPDP) 2023. Some statements are uneven from Western perspectives.

Also, the EU initiated reforms in Ukraine, including IP protection, so vendors often guarantee IP ownership and robust security audits as part of the service. India also follows strong IP practices, but the variation between vendors is higher.

So what: Ukraine = predictability + factual alignment with EU standards. India = common IP practices + touch of inconsistency.

Nearshoring vs. offshoring: Tips for choosing

There’s no one-size-fits-all answer in choosing between nearshoring and offshoring — it depends on your priorities, timelines, and internal capacity. The best option depends on how your team collaborates, the complexity of your project, and your long-term plans.

Consider the time zone

IT outsourcing to India means a 3.5-5.5 hour gap with most of Europe and a 10-12 hour gap with the US. In some cases, this may create problems in sprint planning and direct communication.

Europe could do with Ukraine’s nearshore benefits, and the US (at least, East Coast) has a 6-7 hour overlap with the country, which means same-day collaboration and faster feedback.

Find out the level of remote work adoption

Ukrainian outsourcing companies were pushed to learn how to work remotely:

Backup power systems: portable generators, power banks, switchers, etc.

Deployment of GPON broadband and redundancy initiatives to maintain reliable connectivity.

Local military administration deploys shared-use “points of invincibility” in a couple of hours if necessary.

HCLTech and other Indian tech leaders forcefully adopt remote work and minimise travel in sensitive zones. Their remote culture is growing, but it’s driven more by episodic necessity than sustained infrastructure upgrades.

So what: Ukraine is an old hand in terms of remote work, with built-in remote-first operations and advanced infrastructure resilience. India is trying to catch up at the moment.

Forecast: Local IT outsourcing in the next 5 years

The next 5 years promise to reshape local IT outsourcing landscapes — driven by resurgent investment in domestic tech ecosystems, evolving business needs, and lessons learned from global disruptions. Local IT outsourcing is expected to gain traction as companies seek greater control, closer collaboration, and reduced geopolitical risk.

Growth potential

India expects growth: NASSCOM came up with a new “No Normal” culture for IT outsourcing in India. Updated value proposition includes stability, improvement, and about 2.9% growth in the next 6-7 years. Just a kind reminder: in 2023, the country has a 57-58% share in global sourcing.

Ukraine will recover: EBRD and EU fund country’s rebuilding and recovery (EUR 1.5 billion throughout 2025), so there is nothing groundbreaking in (if the war ends in a year) IT set to grow alongside GDP.

Government initiatives

India supports businesses and investors via STPI, SEZs, and the DPDP Act reforms. But the thing is the real, tangible implementation of those initiatives. Bureaucracy and ripening regulations shake the business environment.

Ukraine will roll out the Diia City 2.0 legal program, reorganize taxes on income, payroll, and R&D. The country is also scaling energy resilience projects and improving reliability for tech companies.

India vs. Ukraine in software development outsourcing

Volume: India remains far ahead in sheer size and market reach.

Quality, agility, alignment: Ukraine stands out with a stronger time-zone fit, faster scaling, and proven endurance during crises.

Strengths: Ukraine narrows the gap through tax benefits, niche capabilities (AI/security/embedded systems), and Western-aligned management.

So what: Over the next five years, India will likely retain its volume leadership. Ukraine, though, will probably secure its renown as a robust nearshore hub for clients requiring high-quality, resilient, and culturally aligned delivery.

Conclusion

In 2026, there are several robust and stable leaders in software development, including India and Ukraine. Choosing the right provider, don’t stop at offshore development costs in Ukraine or India.

Size up time zone, mindset and business practices, resilience, popular tech stack, and delivery.

In search of Ukraine’s outsourcing companies, make sure to check your potential partner or contact local experts.

Tap into Ukrainian tech expertise with a time-to-market advantage and up to 50% budget savings