Where to find great developers? Western companies more often turn their attention to Eastern Europe.

Thanks to a large talent pool, cost-effectiveness, and a favorable business environment, it has become a highly popular region for software development outsourcing. According to Statista, the local IT outsourcing market is expected to grow at a CAGR of 6.82% from 2025 to 2030, resulting in a market volume of US$7.43bn by 2030.

Yet, are all countries within the region equally attractive? Recently, Poland, Romania, and Slovakia have been in the limelight. But which one can be the best fit for your team’s needs?

This guide compares all three destinations across cost, talent, seniority, and collaboration factors to help you make a data-backed decision.

Developer rates in Slovakia, Poland, and Romania (2026)

Get it right: we aren’t among those who consider price as the only decisive factor for choosing an outsourcing partner, the quality of services is equally important. Yet, we are realists and are aware of the fact that cost-efficiency is usually the primary reason for outsourcing. Therefore, we’d like to talk about money matters first.

As you know, rates for software development services can vary from country to country. Sometimes the difference is slight, sometimes significant. What does the range of rates depend on? In fact, there are a bunch of factors:

Talent supply vs. demand: Larger talent pool → more competitive pricing

Seniority distribution: More senior engineers → higher average rates

English proficiency: Higher language proficiency → global demand for local engineers → higher rates

Outsourcing ecosystem maturity: Well-developed outsourcing markets → higher demand → higher rates

Currency strength: Weaker local currency against USD/EUR → more cost-effective rates for foreign clients

Taxes and employer-related costs: Higher employment-related costs → higher vendors charge.

But let’s get back to our three countries – Poland, Romania, and Slovakia – and see what rates local software development companies offer:

Country

Average hourly rate

Junior developers

Middle developers

Senior developers

Cost of living index according to

Wise

Source: Resquad AI

As you see, Romania offers the most budget-friendly rates, especially for junior and middle engineers. Poland sets higher prices, driven by higher living costs, a massive talent pool, and a mature tech market used to working with large international clients. Slovakia stays in the ‘reasonable comfort zone’, with moderate rates that align with its smaller but highly skilled workforce.

However, it’s worth mentioning that even within the same country, rates differ between service providers. The key facets here are the following:

Company size and brand reputation: Renowned vendors with established delivery processes, certifications, and enterprise clients charge more.

Location: Rates in the big tech hubs are usually higher.

Availability of certifications: Maintaining standards like ISO 27001, ISO 9001, PCI DSS, or SOC 2 increases operational overhead, resulting in higher rates.

Niche positioning: Enterprise-focused companies usually offer higher rates, while startup-focused companies come with more flexible pricing.

Industry specialization: Vendors specializing in highly regulated or technically demanding domains like fintech, automotive, healthtech, blockchain, and telecom often charge higher rates because their domain expertise allows them to ramp up quickly and add value sooner.

Talent pool and engineering skills

A rich talent pool is one of the key drivers of the outsourcing market. Let’s see what our trio has to offer.

Poland

Today, Poland is one of the most popular nearshoring destinations in Europe thanks to its capability to support both small specialized teams and large-scale development centers. The research shows that the local ICT workforce includes more than 650,000 specialists, which is the largest talent concentration in Central and Eastern Europe.

This is explained by quite a large population - 38,036,118 people - and an excellent education system. In the 2023-2024 academic year alone, about 74,000 students enrolled in ICT-related fields across Polish universities, ensuring a consistent flow of fresh talent into the ecosystem.

University of Warsaw, Warsaw University of Technology, AGH University of Science and Technology, Jagiellonian University, and Wrocław University of Science and Technology are the top technical universities of the country that annually deliver highly professional ICT specialists.

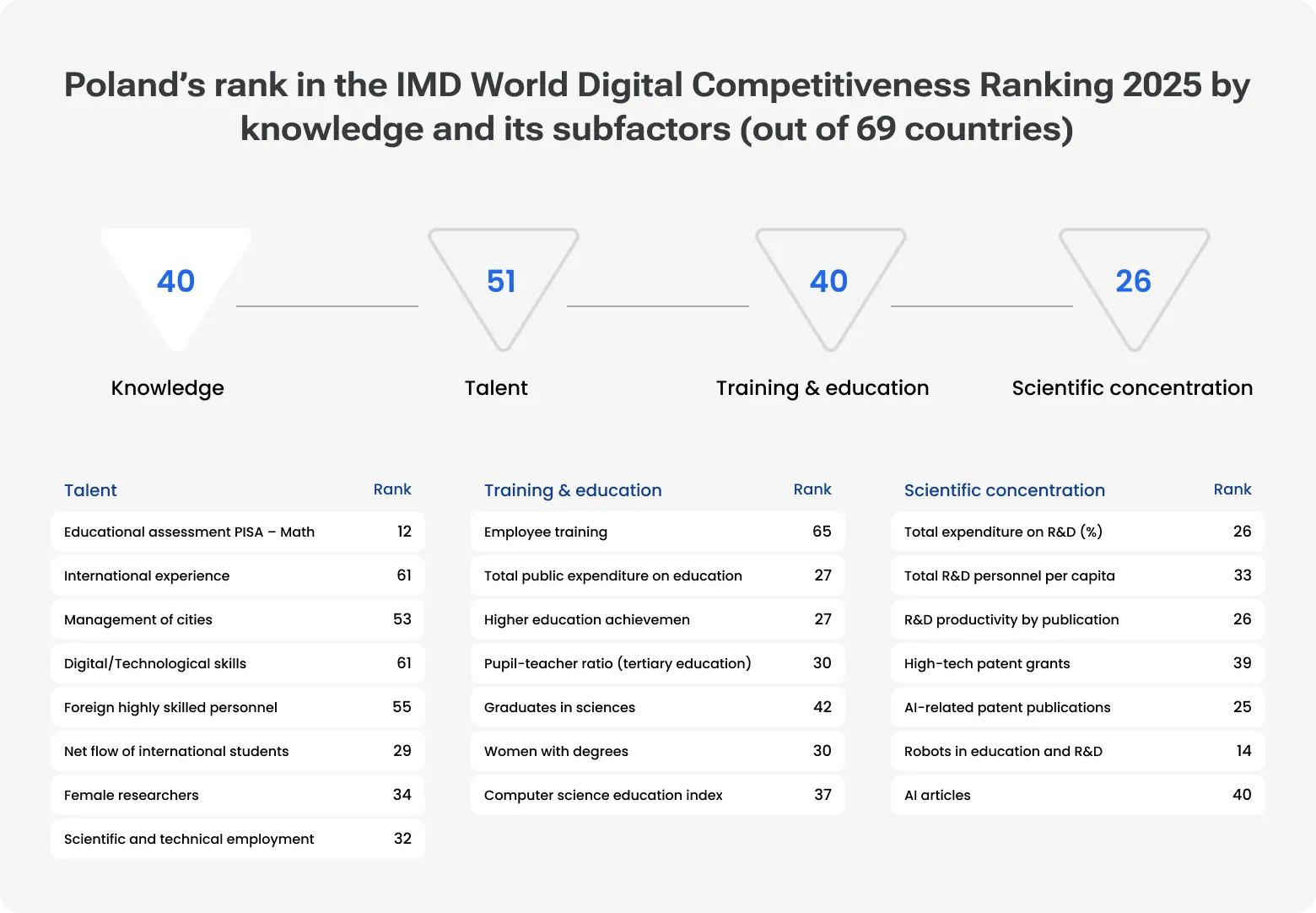

Source: IMD

Another important factor is international talent attraction. Poland draws in a lot of IT professionals from neighboring Ukraine and Belarus, further expanding its talent pool.

Many regional cities here have turned into specialized technology clusters, with Kraków and Wrocław (often called ‘Polish Silicon Valley’) the largest ones, specializing in enterprise technologies, backend development, security, and large-scale digital products.

Romania

Romania can also boast a skilled yet less numerous ICT workforce. There are about 250,000 IT professionals. With technical universities in Bucharest, Cluj-Napoca, Timișoara, and Iași, the country produces about 10,000 IT graduates annually, contributing to its talent pool.

Source: IMD

However, in spite of a high number of graduates, Romania faces a problem of retaining this talent in the country. According to the European Commission’s Digital Decade 2025 country report, the number of ICT specialists in Romania is stagnating, which could put the country’s 2030 target at risk.

Yet, today Romania offers an outsourcing-heavy culture and IT professionals excelling in web and mobile development, Java, C#, cloud technologies, cybersecurity, and fintech.

Slovakia

The data from the Statistical Office of the Slovak Republic shows that the average number of employees in the ICT sector in Q2 of 2025 reached 81,167. Of course, this is much fewer than in Poland or Romania, but for a country with a population of only 5,413,813 people, this figure is not so bad.

Speaking about education, Slovakia has a few notable universities with IT programs: Comenius University, the Technical University of Košice, and the Slovak University of Technology in Bratislava. The country is particularly attractive for international ICT students due to its high-quality education and affordability.

Source: IMD

However, the number of tertiary students in STEM fields here, including ICT, is lower than the EU average. In 2024, a total of 965 students successfully graduated from the Faculty of Electrical Engineering and Informatics at the Technical University of Košice, as well as programs under the Institute of Mathematics and the Institute of Informatics at Pavol Jozef Šafárik University in Košice. So, tens of thousands of ICT graduates annually isn’t about Slovakia.

Along with this, ICT professionals are among the 10 most sought-after professional profiles here, with an estimated 3.6% annual employment growth between 2022 and 2030, higher than the EU average at 2.5%.

The key specializations here are automotive, fintech, embedded software, and backend engineering.

Language and communication – Slovakia vs. Poland vs. Romania developers

For efficient collaboration with an outsourcing partner, English proficiency, cultural alignment, and shared corporate culture are just as important as strong hard skills.

Luckily, Poland, Romania, and Slovakia all score very high in this regard. While each country has its own linguistic landscape and communication nuances, all three show strong English proficiency, a Western-style business culture, and a collaborative mindset formed by years of cooperation with US and EU clients.

English proficiency

Poland ranks among the top English-speaking countries in Europe. According to the EF English Proficiency Index 2025, it places 15th globally, which is within the ‘Very High Proficiency’ category. As a result, Polish engineers are a good fit for international cooperation with multi-team environments that require daily communication.

Romania doesn’t lag behind – it ranks 11th globally, according to the EF EPI 2025. However, apart from great English command, many Romanian IT professionals also speak French, German, and Italian. This is a result of strong connections with these countries in the past and education patterns that make the country attractive today for companies with multilingual customer-facing needs.

Among all three countries, Slovakia is the leader in English proficiency, ranking 10th in the EF EPI 2025. In fact, English is the norm in the local ICT sector. Besides, because of the geographical position and economic relations with the DACH region, many Slovak developers also speak German, at least at an intermediate level. Companies operating in the DACH-driven domains, like manufacturing, automotive, and industrial automation, view this as a big advantage.

Business communication style

Polish developers use a rather straightforward and structured approach to communication. Still, they are professional and task-oriented. Fluent English, strong documentation writing practices, and ease with agile ceremonies are common things. Besides, most teams here are used to remote international setups.

Romanian engineers are known for flexibility and collaborativeness. They easily adapt to clients’ communication style, whether it’s formal, like in Germany or Switzerland, or more casual, like in the US and the UK. Because of the outsourcing-heavy environment, most professionals are accustomed to Western work standards, frequent status syncs, and cross-cultural teamwork.

The communication culture of Slovak developers is usually structured, clear, and a bit formal, although IT teams that work with foreign clients adopt a Westernized, agile-driven communication style. Local engineers collaborate a lot with multinational R&D teams, especially in automotive and fintech.

With regard to all said above, communication hiccups in these countries are rare and minor. Yet, not only smooth communication but also cultural similarities, shared holidays, and aligned expectations around deadlines and obligations make Poland, Romania, and Slovakia excellent nearshoring choices.

Hire software developers in Slovakia

Time zone and collaboration

If you build or augment your dev teams across borders, time zones have a great impact on your workflow. In these terms, the location of Poland, Romania, and Slovakia is more than convenient for real-time collaboration, especially for European and UK companies.

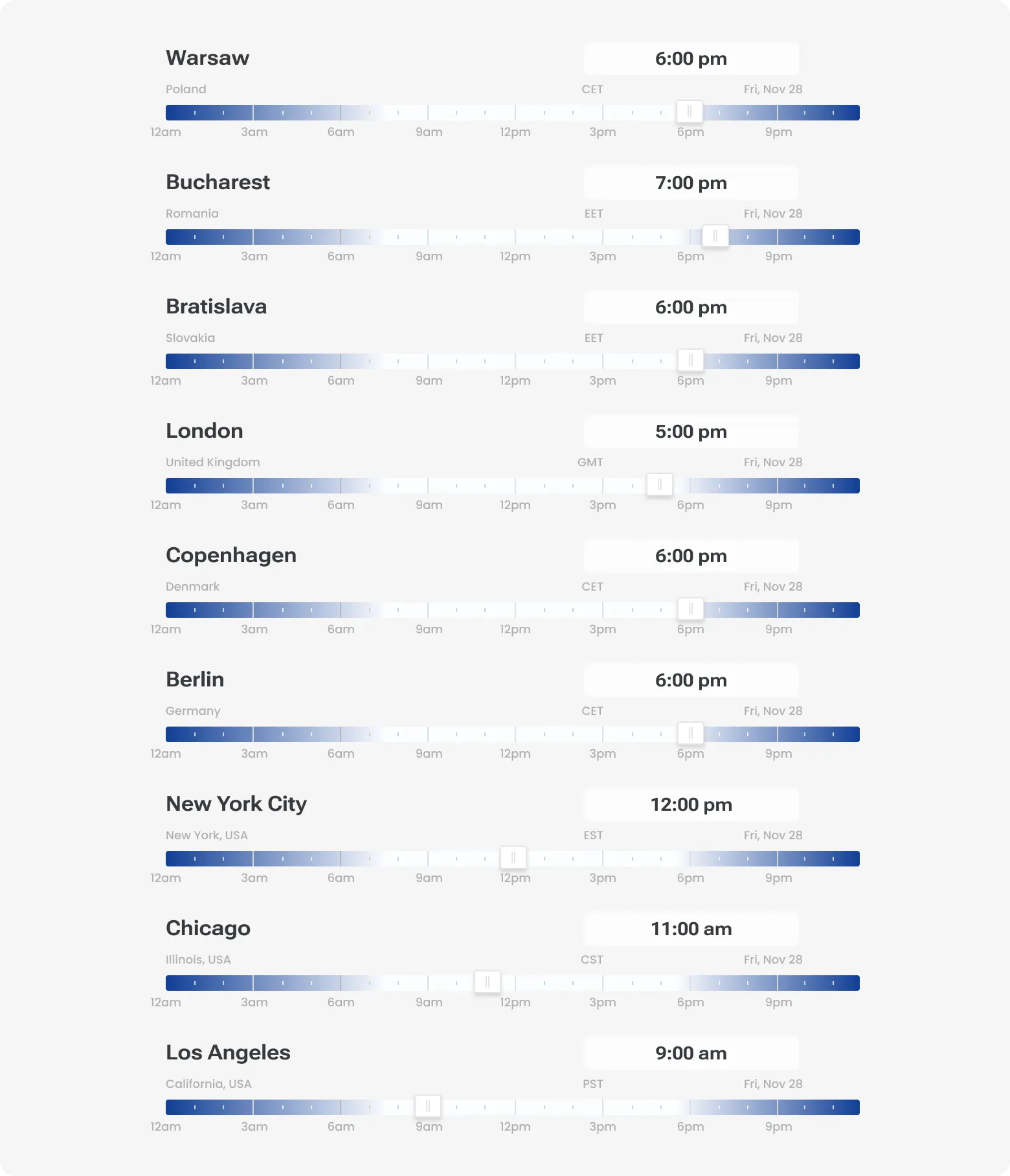

While Poland and Slovakia are in Central European Time (CET, UTC+1), Romania is in Eastern European Time (EET, UTC+2). The table below shows exactly how this aligns with huge hubs in Europe and the US:

Time difference between the largest European and US cities

For European clients, business hours entirely or almost entirely overlap. A morning call in London is still a late morning call in Warsaw and Bratislava, and just a bit later in Bucharest. Companies in Western Europe looking for nearshore development teams in Eastern Europe usually opt for one of these three countries for this reason, too.

For US teams, conditions are less favorable but still workable. For example, for EST (UTC-5), the overlap with Slovakia or Poland is about 3–4 hours in the morning, and with Romania it’s around 2–3 hours. As a result, US-based clients can have morning stand-ups, demo sessions, or sprint planning. Tools like Jira, Confluence, Slack, and GitHub also help keep cross-Atlantic projects running without hiccups. Documentation, progress updates, and asynchronous code reviews let work keep going even when teams aren’t online at the same time.

Hire software developers in Romania

Outsourcing maturity and vendor availability

A thriving outsourcing ecosystem, a variety of vendor options, and a pool big enough to serve different needs are important factors for a positive outsourcing experience.

Poland

The country is an undisputed leader in nearshoring in the EU. This is mainly explained by its great scalability and maturity.

Significant vendor network: As of November 2025, Clutch lists 1,025 Polish IT outsourcing companies.

Ample talent pool: Poland has the largest number of IT specialists in Central and Eastern Europe. Whether you want a small frontend team or a full-fledged 50+ developer center, Poland always has a vendor to match.

Long track record: Having been in outsourcing for many years, Polish vendors are particularly good at enterprise-grade processes, compliance requirements, cross-cultural teamwork, and cross-time-zone cooperation.

Variety of tech skills: Taking into consideration the size of the local market, you can find here any skill set, be it something related to cloud technologies, backend development, blockchain, AI, etc.

The gist: Poland allows you to find any skill set and scale fast. If your product is evolving and you require a lot of senior engineers, Polish vendors can support you.

Romania

This is a great option if you are looking for a destination where flexibility, budget-friendliness, and quality come together.

Availability of outsourcing vendors: There are 395 Romanian IT outsourcing companies on Clutch. They provide different engagement models, like dedicated teams, staff augmentation, and managed delivery.

Long outsourcing history: Local companies have been serving EU and US clients for many years, so they have plenty of experience with the remote model of work and Western standards.

Professional services for an affordable price: Partnership with Romanian outsourcing companies gives a chance to bring in experienced specialists for a lower price than in other popular outsourcing countries. Along with this, you take advantage of EU‐level regulation and business practices.

Agile mindset: Working on fast-moving startups has helped many local vendors hone their adaptability, speed up onboarding, optimize internal processes, and adopt a client-centric delivery approach.

The gist: If you need a trusted outsourcing partner for not all the money in the world, Romania can give you good quality at an affordable price.

Slovakia

As you already know, Slovakia has a modest talent pool in terms of size, but when you hunt for experts with narrow specializations or small dedicated teams, it’s a really good option.

Compact vendor community: While not as large as Poland’s and Romania’s, the Slovak market comprises trusted IT outsourcing providers and engineering shops (Clutch lists 89).

Skill over size: Because the pool is much smaller, local vendors are usually more picky. Therefore, in Slovakia, you’ll find tighter-knit teams, proficient engineers, and better accountability, which is a good mix for projects where domain expertise and diligence are more important than headcount.

Specialized skills: Embedded software, industrial automation, and fintech are key specializations of local vendors. For such projects requiring special knowledge or falling under domain regulations, Slovak companies bring the needed expertise and skills.

The gist: If you don’t need a multitude of developers but a small, competent team with in-depth domain knowledge, Slovakia can be a good choice.

Hire software developers in Poland

Political and economic stability

It might not be obvious, but stability in politics and economics may affect the continuance of cooperation with an outsourcing company. In this sense, Poland, Romania, and Slovakia provide confidence. As EU members, they have clear regulations, GDPR standards, and a business environment that supports long-term cooperation.

The Republic of Poland is an economic power in the region. Its GDP is the 6th largest in the EU by nominal standards. According to the European Commission report 2025, Poland’s economy is one of the fastest-growing in the EU, while macro-financial challenges and risks remain limited here.

Romania has a developing mixed economy and ranks 12th among the EU countries by total nominal GDP. Its government has been advancing structural reforms to meet all the EU norms. In fact, its economic growth has been one of the highest in the EU – in 2024, Romania’s GDP per capita in purchasing power standards reached 78% of the EU average, up from just 44% in 2007 when the country joined the EU. That’s a big leap!

As for the Slovak Republic, it is a country with a high-income developed economy. In 2024, its GDP per capita equaled 75% of the EU average. The Slovak government actively welcomes foreign investment because it’s one of the key drivers of the local economy. And, thanks to low tax rates, a well-educated workforce, and EU membership, Slovakia does attract foreign investors.

Final thoughts on which country to choose

Software development outsourcing in 2025 is a common practice for tech companies all over the globe. A quick team ramp-up, cost reduction, engagement of a narrowly specialized expert – there are plenty of reasons to tap into it.

If you’ve decided to outsource developers in Europe, Poland, Romania, and Slovakia may be key locations to consider. Yet, each of them comes with strengths and weaknesses. Which one to choose?

Hire developers in Poland if you need:

Large, fast-scaling teams

Enterprise-level delivery

Extensive experience with large, complex projects

Hire developers in Romania if you want:

A strong price-value balance

Flexible teams and startup-friendly collaboration

Hire developers in Slovakia if you need:

Small but extremely professional teams

Broad expertise in fintech, embedded software, automotive, and backend engineering

A cost-effective, EU-based partner

So, make your choice based on the careful analysis of your needs, plans, and priorities. And remember that regardless of the country you choose, Devio can be your reliable outsourcing partner. Here, we help companies bring in top-tier developers across Poland, Romania, Slovakia, and other countries.