The Future of Jobs Report 2025 says that about 78 million net new jobs will be created by 2030: 92 million roles will be displaced, and about 40% of currently profitable skills will age out.

AI, big data, cybersecurity, and software product development are the next (already current, actually) big things.

This is why top software outsourcing countries will be even more demanding. Pressure on costs, remote work maturity, and tight hiring markets in Western economies are pushing companies to search for talents outward.

However, the lowest cost isn’t always safest: delivery consistency, legal compliance, time-zone overlap, and developer quality make a big difference.

Let’s break down the best countries for outsourcing software development. Below, we evaluate each on talent availability, cost, communication, infrastructure, and delivery maturity.

Ranking methodology

Devico has experts in Eastern and Western countries, so we can rely on both internal and external knowledge. The countries below are placed in free order, but have certain evaluation criteria. Namely:

-

Tech talent availability: General size of the talent pool. Here and there, we specified exactly devs in the outsourcing niche. Also, we didn’t forget the annual STEM graduates.

-

Cost efficiency: Expressed in either average hourly rates or annual salary, but always in correlation with seniority levels.

-

English and communication: EF EPI score, general communications patterns, and working culture.

-

Delivery maturity: How long the country has been securing outsourcing deals, the presence of major product behemoths, agile adoption, etc.

-

Risks and challenges: From political issues to wage stress.

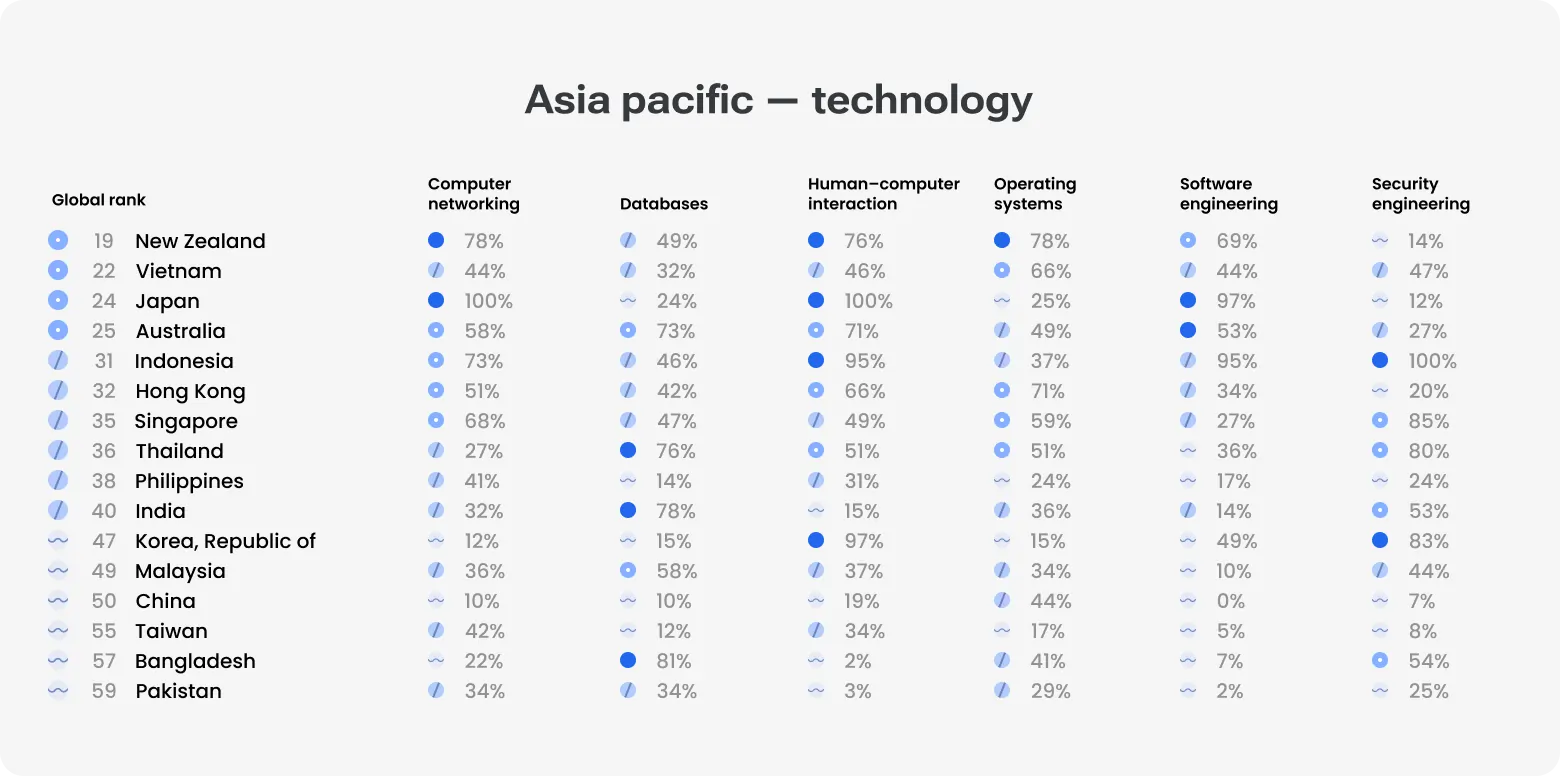

We gathered fresh 2024-2025 data, compiled EF, HackerRank, Stack Overflow, and regional hiring insights.

If you have any questions or even a specific inquiry on hiring in Eastern or Western countries, feel free to contact us.

1. Poland

A more stable country compared to Ukraine and many others…until recently. At least, we see what’s happening in the geopolitical arena and should definitely anticipate potentially unpleasant scenarios. For now, Poland constantly enters any possible list of best countries to outsource software development to and is a go-to destination for global corporate business leaders.

Developer availability

Poland had 500,000+ software developers as of 2023 (with a slight correction due to migration from Ukraine). Anyway, it’s the largest IT talent pool in Central and Eastern Europe. Each year, Polish universities graduate over 15,000 STEM students.

Top-of-mind educational institutions are Warsaw University of Technology, AGH University of Science and Technology in Krakow, and Wroclaw University of Science and Technology. Poland scored in the top 3 of HackerRank in the 2019 global coding competitions.

Average rates

Mid-to-senior devs typically charge USD 35-70/hr. This is above Ukraine or Romania, but still far more competitive than the USD 90-120+/hr common in the US and Western Europe. But for this money, clients get strong quality control, agile delivery methods, and low rework costs.

Language and communication

Poland ranks 15th globally in the EF English Proficiency Index 2024 (by the way, France, Italy, and Spain are behind). Expect direct and transparent communication, similar to Western business rules. Project documentation and code reviews are typically in English, too.

Time zone fit

The CET/CEST zone is ideal for European clients, with a full-day overlap. The companies from the US and Canada typically have a 3-6 hour overlap with East Coast working hours, which is often enough for daily syncs.

Tech strengths and specializations

Payment services and artificial intelligence are probably the most outstanding niches for Poland.

Fintech and banking: PSD2, SEPA, and EU finance integration.

Cybersecurity: GDPR-aligned systems and SaaS security audits.

Can’t help mentioning CD Projekt Red, which is behind The Witcher, and Allegro (Poland’s Amazon-like marketplace). Poland also has a growing blockchain and Web3 ecosystem, especially in Warsaw and Krakow.

Why companies outsource here:

Large and reliable talent pool

EU membership, GDPR compliance, and strong IP protection laws

Mature delivery centers from behemoths: Google, IBM, and Accenture

Quality multiplies cultural alignment

Challenges and risks

Poland’s main challenge is further escalation of the war in Ukraine; the recent Russian drone intrusion is proof.

Another challenge is rising Polish developer costs due to demand from international clients and the soaring cost of living. Talent competition can lead to higher attrition rates for long-term projects.

Last but not least, the government has periodically adjusted tax rules for IT contractors, creating short-term uncertainty for companies relying on B2B contractor models.

Hire software developers in Poland

2. India

Until recently, India was considered the best country for outsourcing software development, but it may be losing that title due to new emerging destinations and political tensions in the region. Yet at the moment, the country is still among the leaders as a go-to choice for software development outsourcing.

Developer availability

India’s IT-BPM sector is gigantic compared to Eastern Europe’s — about 5.4 million people and USD 194 billion in exports. There are several universities in India recognized globally (the IITs and NITs). In 2025, the top 3 universities from India are the following:

-

IIT Delhi: 171st globally

-

IIT Kharagpur: 202nd globally

-

IIT Bombay: 234th globally

Average rates

A mid-to-senior Indian full-stack developer charges USD 20/hr. Note that they might have communication difficulties and process misalignment. In indirect terms, you double the overall project cost.

Also, note that rates for captive GCCs (Global Capability Centers) or premium product shops often sit above the standard service-house bands.

Language and communication

English is widely used as the business language in Indian IT. Being at #69 in the global index, Indians’ communication style is adaptable — many teams blend asynchronous documentation with frequent synchronous touchpoints for sprint ceremonies and stakeholder updates.

If you are afraid of serious miscommunication, rest assured that written English in client-facing roles is generally ok, especially in major hubs (Bengaluru, Hyderabad, Pune, Chennai, NCR).

Top-tier engineering orgs have operated under Western SDLCs, SLAs, and compliance requirements for the past 7-9 years.

Time zone fit

India (IST, UTC+5:30) has a limited overlap with Western Europe and an even more modest overlap with the US. Many Indian teams operate shifted schedules or follow-the-sun handoffs to provide necessary overlap for American clients. GCCs also staff local shifts to increase synchronous collaboration.

Tech strengths and specializations

Apart from being in the list of top software outsourcing countries, India has a product fame as well:

BFSI and core banking: Legacy modernization, payment rails, and large-scale transaction systems.

E-commerce and retail platforms: high-throughput architectures, integration at scale.

Generative AI/ML: Impressive growth in AI/ML hiring (+36% in 2024); Yellow.ai and other famous AI/ML startups that have raised USD 40M+.

BPM/contact centers: Still a comparative advantage for voice/omnichannel services.

Why companies outsource here:

Scale: Chances are, you won’t find more capable destinations for large headcount ramps and talent pools across stacks.

Cost: Significant savings compared to Western Europe/US on a loaded basis.

Innovation: Strong startup ecosystems (Bengaluru, Hyderabad) with cloud-native, AI, and product engineering teams.

Challenges and risks

Time-related friction. US/EU clients mainly want same-day synchronous overlap.

Inconsistent quality across the market. A large variance exists between top product shops and smaller service houses.

Competition for senior AI/cloud talent. Hot demand = retention pressure and wage inflation.

Hire software developers in India

3. Ukraine

Years come by, but Ukraine is still among the best offshore software development countries. Doubtless, there are a lot of risks in outsourcing to Ukraine, but there are also many leg-ups.

Developer availability

The latest estimations show the country has 250K+ tech specialists living and working exactly in Ukraine (because many Ukrainians are living across Europe now but working for Ukrainian companies).

Despite the influence of the Soviet CS/math lineage, top Ukrainian universities didn’t freeze in Soviet educational programs.

Kyiv Polytechnic Institute (KPI), Ukrainian Catholic University, Taras Shevchenko National University, Lviv Polytechnic, Kharkiv National University of Radioelectronics are top-of-mind options for students targeting tech specializations.

These institutions invite Senior practitioners from the local and worldwide tech industry to give lectures and teach the youth what matters.

There are also many private academies, such as EPAM University, SoftServe Academy, and Mate Academy, which convert graduates into production-ready engineers.

Why it matters: Ukraine supplies a deep bench of mid-to-senior engineers who have shipped at scale for international product and enterprise clients. Useful when you need experienced ICs rather than only junior capacity.

Hire software developers in Ukraine

Average rates

As of 2024-2025, typical outsourcing rates in Ukraine are around USD 25 to USD 55/hr for common stacks, but senior/specialized roles push above. This is an average at Upwork, Arc.dev, and PayScale. Rate surveys and vendor benchmarks converge on this band, though specific quotes depend on stack, seniority, and delivery model.

Language and communication

EF’s 2024 English Proficiency Index places Ukraine at #40 out of 116 countries. Rest assured, client-facing PMs, architects, and delivery leads have at least B2 level, and documentation, sprint artefacts, and code reviews are routinely English-first. Since the engineering culture emphasizes ownership, pragmatic problem-solving, and formalized asynchronous communication, it is good for distributed setups.

Time-zone fit

The local zone – EET/EEST – is just one hour ahead of Central European business hours. For US teams, overlap is smaller but workable (US East Coast late afternoon = morning in Ukraine). Many clients combine async handoffs with daily overlap windows for planning and demos.

Tech strengths and specializations

AI/ML & data engineering: Significant product work in NLP, computer vision, and MLOps. Ukraine has recently started developing its own LLM. Only Poland has more AI startups in Eastern Europe than Ukraine.

Cybersecurity: Real-world exposure to sophisticated nation-state threats pushed local expertise in SOC, incident response, and secure-by-design apps.

Fintech: Ukraine has a knack for launching humanized neobanks. Monobank (local one), Kioto (The UK), and others have paved the way for globally recognized expertise.

Embedded/firmware and real-time systems: Kharkiv and selected teams retain strong skills for low-level engineering and IoT.

Why companies outsource here:

Cost-to-quality balance: Western-quality delivery, thorough alignment, and reworks-if-the-plan-changes included.

Proven export track record: IT services are now the country’s #1 service export (USD 9.3B+ in 2024), with the top buyers being the US, UK, and Malta.

Challenges and risks

Geopolitical risk: Attacks on energy infrastructure remain a risk, but industry and utilities have invested in redundancy and rapid restoration. ACAPS investigated targeted strikes in 2024-2025 and notes significant recovery efforts and decentralized power solutions used by providers to keep services available. So, buyers should demand that providers demonstrate BCPs and geo-redundancy.

Talent mobility: EU relocation and remote-work mobility increase competition for senior ICs.

Rate pressure on niche skills: AI/security specialists are in high demand, so plan for higher rates and longer ramp times.

What buyers do in practice: Require evidence of Diia.City or formal legal structures for IP/tax clarity, ask for BCP proof (regional pods, backup power, cloud failover).

4. Romania

We can’t ignore Romania discussing the best countries to outsource software development. With about 190K tech pros, it’s gaining ground as a go-to choice if Poland and Ukraine are not considered due to risks or any other factors.

Developer availability

Romania has moved from an “emerging” to a serious regional engineering supplier. You won’t find much research, but the most reputable ones mention the active local IT workforce in the 190K-200K range.

Key universities run special programs that nurture junior and mid-level engineers, and the number of STEM graduates is above Europe’s average, 29.1% vs. 24%.

Totally, they have about 9K-10K freshly-backed tech specialists, backed by private bootcamps and returnees from EU/US diaspora programs.

Average rates

USD 25-USD 45/hr range for mid-level developers and USD 45-USD 75/hr for senior specialists/niche roles. This is slightly higher than Ukraine’s lower bands but typically below Poland’s tops.

Regarding a full-time salary, they align on this mid-range positioning — cheaper than Western Europe but typically pricier than the lowest-cost Asian markets.

Tip: Build a 10-20% premium for bilingual product teams or cloud/SRE specialists that must manage production SLAs.

Language and communication

Romania ranks #10 in CEE and #12 globally in English proficiency. Written artifacts and sprint rituals are typically English-first, especially in large providers. Local language (Romanian) is used internally but has little impact on client communication.

Additionally, Romanian engineers are used to Western rituals, like sprint planning, CI/CD pipelines, and code review SLAs.

When you hire remotely, conduct your tech interviews in English (system design whiteboards), the same with a written take-home task that mirrors your production stack. This will help you validate both language and technical fit.

Time zone fit

Typical Eastern European time zone doesn’t have any changes compared to Poland or Bulgaria. EET/EEST gives near-perfect overlap with Central European clients, and for US companies, many Romanian vendors run partial shifts or create EU-based delivery teams to provide more synchronous coverage.

Tech strengths and specializations

Cyber- and cloud security: Local companies typically have strong capabilities in SOC, pentesting, and secure operations. Cloud and SI, BI and Big Data consulting take 7.3% and 5.5% of all services. Great share, considering almost 200K tech professionals and 400+ ICT companies.

E-commerce and retail platforms: Mature teams creating high-traffic platforms and integration with EU payment rails.

Automation and RPA: There is an entire ecosystem for workflow automation projects.

Romanian companies combine full-stack Node/React or Java/Spring teams with dedicated DevOps (Terraform, Kubernetes) and SRE practices. You’ll find seasoned engineers comfortable building event-driven architectures, streaming platforms (Kafka), and deploying infrastructure as code in multi-cloud setups.

Why companies outsource here:

Convenience for top EU clients: Like-minded culture, strong English proficiency, EU legal alignment through GDPR.

Balanced cost vs. skill: Better senior availability than many smaller CEE peers. Reasonable rates.

Commercial playbook: Excellent fit when you look for where to outsource software development to get product-grade teams with adherence to EU rules, but within reason.

Challenges and risks

Fragmented market: Many small teams and consultancies with inconsistent quality.

Senior hiring competition: Retention requires career paths and technical ownership. Seniors expect more benefits, both material and non-material ones.

Scale limits for massive programs: Romania’s total pool is smaller than Poland’s, so consider a multi-country sourcing plan.

Legal nuance: EU employment law and local tax rules make long-term contractor models risky. So structure long engagements as employer-of-record or dedicated team contracts that clearly transfer IP and contractual protections.

Hire software developers in Romania

5. Philippines

For at least the last two decades, the Philippines has held its place among the top software outsourcing countries. Large talent pool, relatively high English proficiency, and global recognition. Let’s break down what’s what.

Developer availability

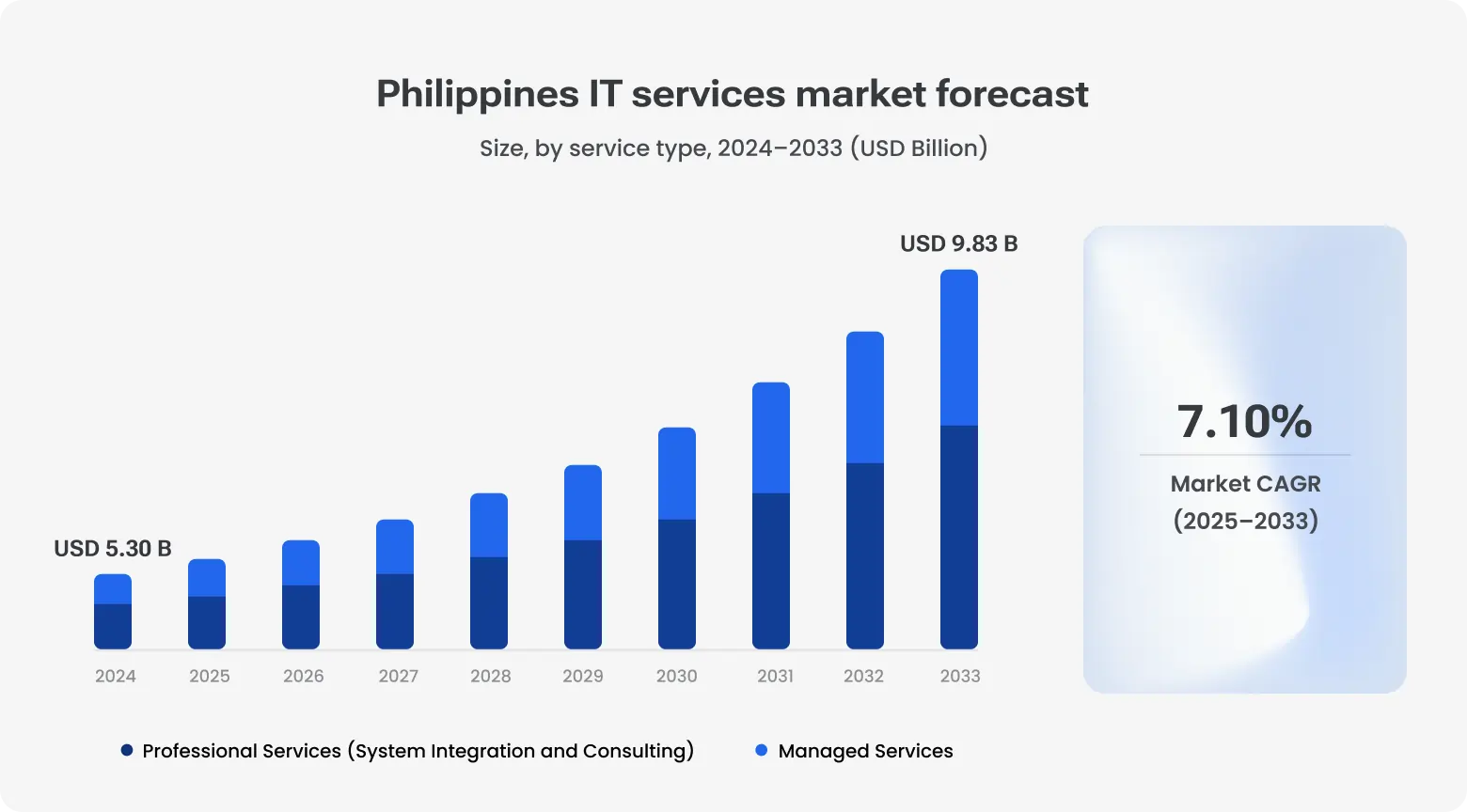

The Philippines has historically been associated with business process outsourcing and shared services. And the market is set to reach USD 525.23 billion by 2030, with a CAGR of 9.8%. Specifically, the IT outsourcing industry is expected to hit USD 9.8 billion by 2033.

But in the last ten years, it has grown into a serious IT engineering hub. The IT-BPM industry has about 1.5M specialists, but the precise number of software developers is unknown. Even recent DOLE and IBPAP reports don’t specify the actual figures as per 2025.

Previous estimations range from 250K-300K to 800K software engineers and about 60K STEM graduates from universities (the top list contains Ateneo de Manila, De La Salle, University of the Philippines).

DICT’s Digital Cities 2025 roadmap and other governmental programs are accelerating the shift from call-center work to higher-value IT services. Secondary cities (Cebu, Davao, Iloilo) are now home to IT parks and delivery hubs.

Average rates

Market benchmarks put mid-level engineers at USD 15 - USD 35/hr and senior roles at USD 35 - USD 55/hr. Niche skills (AI/ML, advanced DevOps, etc.) will cost USD 60+/hr, but the Philippines remains competitive versus CEE or LATAM.

Salary inflation has been stable compared to India, with a year-on-year increase of 5-8%.

Language and communication

English is one of the country’s official languages and is used in education, business, and government. The Philippines consistently ranks within the top 25 globally in EF’s English Proficiency Index. Communication is heavily “Westernized”: meetings, stand-ups, and reporting are the norm.

Work ethics emphasize deference and politeness, but senior engineers increasingly show initiative and ownership.

Time zone fit

The Philippines is GMT+8, which gives full overlap with US West Coast mornings/evenings and East Coast late evenings. Rest assured, large providers will operate split shifts to maximize overlap.

There is a 6-7 hour difference from CET, which can work for partial-day overlap. Not as seamless as CEE, but still.

Tech strengths and specializations

Fintech and banking platforms: Large GCCs (Citibank, JPMorgan) have R&D hubs in Manila.

Healthtech: Main clients here are from the US. And since there is a healthcare outsourcing boom in the United States, Filipino engineers are familiar with HIPAA-compliant systems and EHR platforms.

E-commerce: Shopify app development and mobile commerce integrations.

Cloud and DevOps: Philippine teams increasingly deliver AWS and Azure migration projects.

Why companies outsource here:

Challenges and risks

Talent segmentation: top engineers are concentrated in Manila/Cebu; smaller hubs sometimes lack depth.

Massive relocation risk: experienced engineers occasionally migrate to Singapore, Hong Kong, or the Gulf. Mitigation: ask vendors for 24-month retention data and turnover metrics.

Natural disaster resilience: the country is typhoon-prone; some outages have hit BPO/IT centers Mitigation: top vendors already deploy redundant data centers and DR practices — validate these in your RFP.

Scaling to 200+ FTE: unlike India, the Philippines can struggle to ramp massive dev programs in <12 months. Solution: combine PH with India or Vietnam in regional hubs.

6. Mexico

We couldn’t avoid mentioning Mexico among the best countries for outsourcing software development. Despite some slowdown, the Mexican IT market growth is stable, with a 13% YoY gain.

Developer availability

Mexican employment data assures us about 300,000+ analysts and software developers. Top local universities are UNAM, Tecnologico de Monterrey (ITESM), and Instituto Politecnico Nacional (IPN).

Can’t help mentioning private technical colleges and bootcamps, which together with public institutions produce ~80,000 tech, electronics, mechanical systems, and mathematics graduates annually.

Mexico has many Global Capability Centers (GCCs) and nearshore delivery centers that absorb and upskill local graduates.

And the icing on the cake: the country is 5th globally in AI research, with 200+ AI startups and USD 3.42 billion market size.

Average rates

Mexico’s mid-level developer average rates are USD 45 - USD 65/hr, with senior engineers commonly USD 75 - USD 95+/hr depending on expertise and city.

Language and communication

Officially, things are not that good in Mexico: the EF EPI puts the country in #87 place out of 116 countries in their ranking. Yet, client-facing teams, GCCs, and export-oriented vendors hire English PMs and architects. Communication is usually direct and relationship-oriented.

Tip: Ask for early-stage written artifacts (API contracts, design docs) to reduce ambiguity when onboarding cross-border squads.

Time zone fit

New economic order forces profitable businesses to look for more reasonable options for where to outsource software development to stay lucrative.

And Mexico’s nearshore advantage is its US time-zone overlap. Central Time and Mountain Time overlap substantially with US East and West Coast working hours. This means daily standups, paired programming, and live stakeholder sessions.

A big advantage in modern fast cycles.

Tech strengths and specializations

Product engineering and GCCs: North American GCCs running product teams and platform engineering here.

Manufacturing, automotive, and IoT: Strong industrial base (namely in Monterrey and Guadalajara) with engineers experienced in embedded systems, hardware integration, and industrial automation.

Fintech: A fast-growing industry, especially taking into account local experience with compliance. By the way, Devico’s CEO, Oleg Sadikov, broke down the Fentech infra topic with a serial Fentech entrepreneur, Jakob Carlbring.

Cloud and AI investments: Major cloud and AI investments. In 2025, about 20 startups in different niches secured investments from top giants and private VCs.

Why companies outsource here:

Time-zone alignment with the US: Ensures real-time collaboration and quick feedback for US teams.

Nearshore advantage: Travel effortlessly, enjoy cultural proximity and legal frameworks familiar to North Americans.

Industry match: A strong fit for manufacturing, automotive software, and fintech.

Challenges and risks

Wage inflation in top hubs: This is actually a common issue in almost all outsourcing hubs. And Mexico City isn’t an exception. Mitigation is also common — build blended teams.

Political and macro uncertainty: Mexico’s political stability indicators are lower than many OECD peers.

Quality variance across vendors: The higher the price doesn’t mean the better the quality. Do technical due diligence and run paid pilots.

7. Vietnam

We see a new star among the best offshore software development countries. To be completely honest, not exactly new. This destination is just gaining ground in light of soaring costs and geopolitical tensions. Let’s break down the nuances of software outsourcing to Vietnam.

Developer availability

Since 2007, when Vietnam joined the World Trade Organization, the country has started investing in STEM education and new policies to make it effortless to establish a footprint here for Western companies.

Considering that nearly half of the population is below 35 years old, the number of software developers is promising (~530,000).

About 55K-60K CS/IT students annually (from Vietnam National University, Ho Chi Minh City University of Technology, Da Nang University, and private academies). So, Vietnam has a large mid-level (at least) bench capable of handling end-to-end product work.

Average rates

The location matters here, maybe, more than elsewhere. According to Glassdoor and snapshots from local outsourcing companies, the average rates look like this:

Junior software developer: USD 17-USD 20/hr

Middle software developer: USD 20-USD 30/hr

Senior software developer: USD 35-USD 50+/hr (we included special skills here, like platform, ML infrastructure, embedded)

Ho Chi Minh City and Hanoi sit at the higher end, Da Nang and regional centres at the lower end.

Language and communication

Vietnam’s EF English Proficiency ranking is #63 globally (mid-range). Smaller boutiques may not be that skilled in English, but two locations have more English-proficient devs, so target Red River Delta and South Central Coast.

Vietnamese engineers are used to working with Western SDLCs, though communication tends to be more document-driven and conservative on estimates.

Time zone fit

APAC and East Asia: Just perfect for Japanese, Korean, and Singapore partners.

Europe: Limited overlap (morning in Vietnam = late evening in Europe).

US: There are small overlap windows.

Vietnam’s sweet spot is APAC-facing product engineering and global projects where synchronous overlap isn’t required full-time.

Tech strengths and specializations

AI/ML: FPT has announced a huge plan to build a USD 200M-worth AI factory, partnering with Nvidia. Additionally, there are many local AI labs focus on NLP, computer vision and industrial AI.

E-commerce and mobile: Strong local product companies create high-throughput mobile and commerce systems.

Embedded and electronics software: Electronics manufacturing base is gaining ground as a world-renowned firmware and IoT engineering experience.

Why companies outsource here:

Scale + attractive rate: Impressive mid/senior bench at lower effective cost than East Asia premium markets.

Rapid upskilling: Employer academies and corporate training nurture productive engineers fast.

AI and cloud capabilities: Local investments give buyers confidence for advanced projects that need MLOps and GPU capacity.

Challenges and risks

English variability: Vet communication skills in interviews for non-English native teams.

Supply chain and geopolitical exposure: Recent tariff shifts and global demand affect fiscal space. World Bank and Reuters coverage showed how trade/tariff headwinds indirectly impact the tech sector.

Vendor maturity variance: Strong enterprise vendors coexist with many small shops.

8. Brazil

A real heavyweight for software talent in Latin America. Alongside Argentina (which is described at the bottom), Brazil is among the best countries to outsource software development. So what’s with the local labor market, what is the real cost, and what are locals good at?

Developer availability

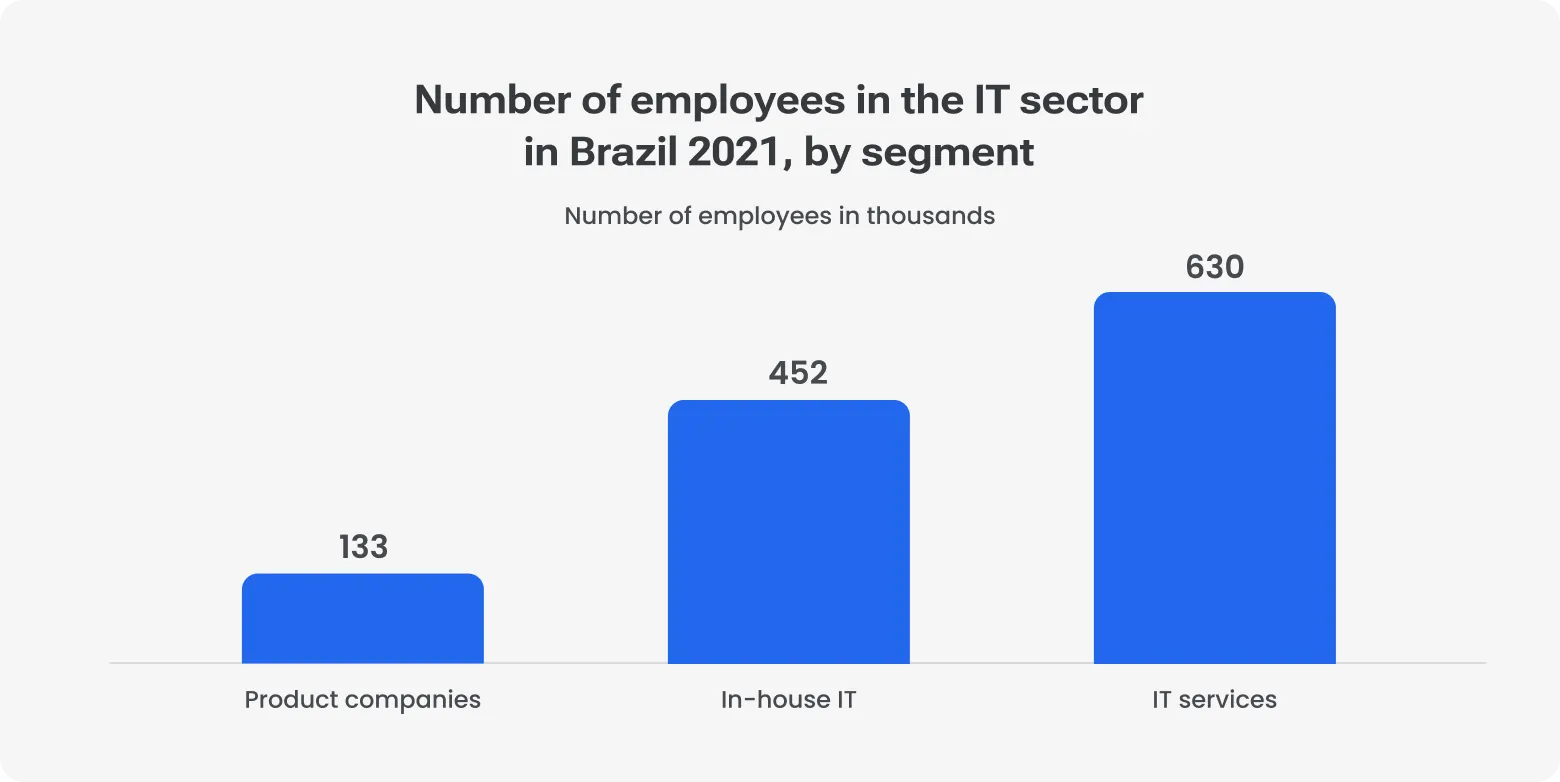

Old estimates (2021) say that Brazil’s developer population is between ~800k and 1.2M, depending on definitions.

The variance comes from whether you count contractors, product engineers, and digital specialists outside traditional payroll.

Top feeders are the University of Sao Paulo (USP), UNICAMP (Universidade Estadual de Campinas), and the Federal University of Pernambuco (UFPE). These universities and other regional institutions (2,457 in total) produce 46,000 ICT students every year, and eleven universities are featured in Latin America’s top 30 rankings by QS for 2025.

Average rates

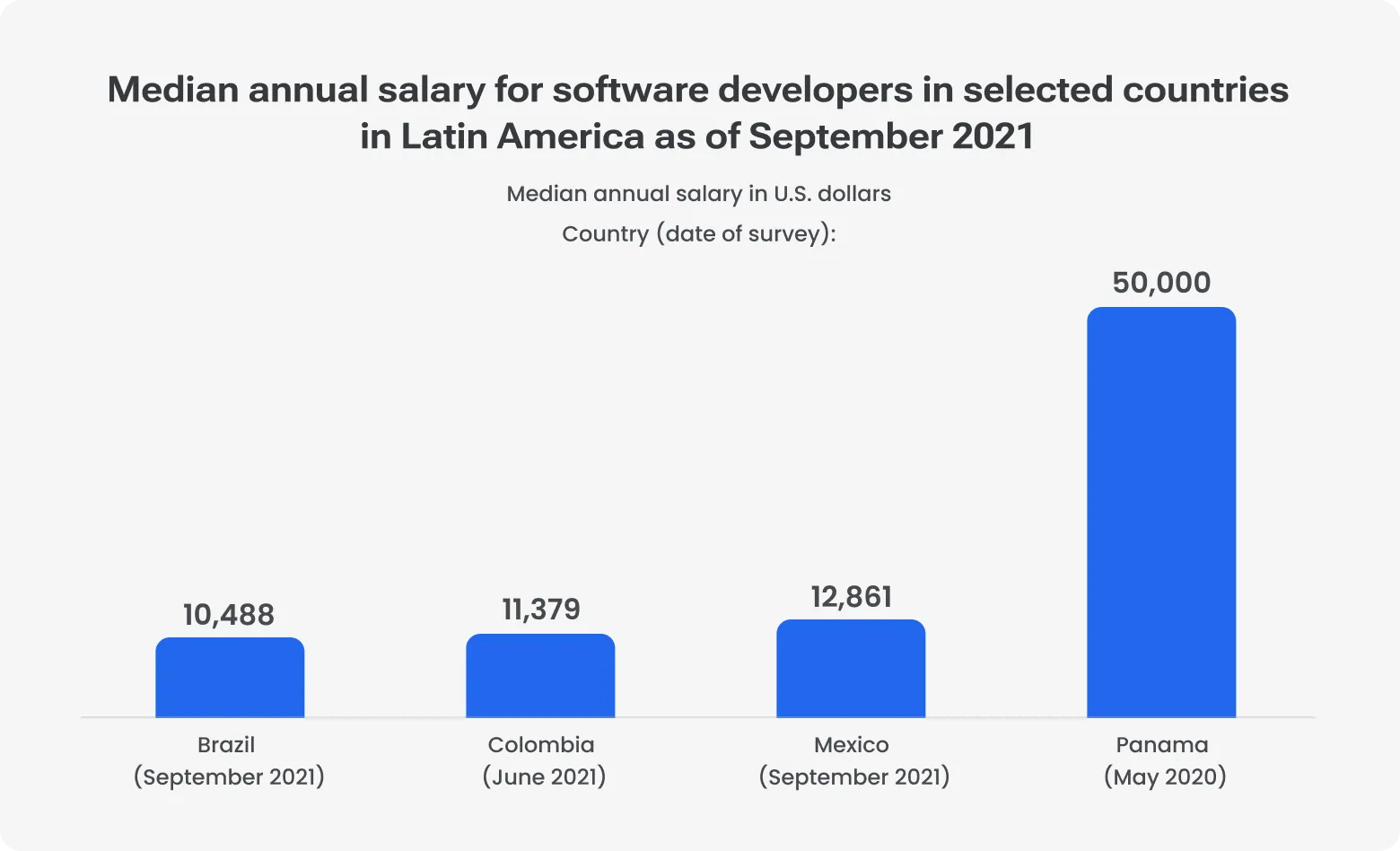

Typical mid/senior bands: Average hourly rates vary remarkably, so we’d better cite annual salaries of in-house specialists across Latin America.

Tip: Add an extra 10-20% premium for guaranteed English-first client coverage or US-shift overlap, and factor currency volatility into multi-year contracts.

Language and communication

English proficiency: #81 out of 116 in 2024. Not that high, but you’ll likely talk to fluent English PMs and architects.

Work culture: Brazilian engineers are product-oriented and collaborative, and many come from startups (for example, Nubank, iFood, Wellhub). Open communication, emphasis on UX and customer metrics, and good cross-functional collaboration.

Time zone fit

US: Great overlap with North and South America.

EU: Smaller overlap; workable for async models.

Tech strengths and specializations

E-commerce and logistics: iFood, VTEX, and other players mean teams used to scaling high-traffic transactional systems.

AI and cloud: This is a common trend, of course, but national AI investments and big vendor projects strengthen Brazil’s MLOps capabilities.

Why companies outsource here:

Scale + product-oriented minds: Brazil staffs whole product squads that already think in a framework, UX → metrics → ops.

Time-zone advantage: If you are from the US, you’ll avoid follow-the-sun overhead and will move faster.

Growing R&D and AI investments: The domestic market size (is expected to hit USD 21.5B by the end of 2025) keeps senior talent from being purely outsourcing-focused.

Challenges and risks

English variability: Outside major vendors and product companies, English level can be a blocker.

Vendor maturity variance: Brazil has both enterprise R&D centers and many small shops, so take our advice seriously — do code reviews and architecture workshops before scaling.

Currency risk: BRL volatility can affect vendor margins and pricing; build FX clauses into multi-year contracts.

9. Bulgaria

The main advice — don’t always believe industry reports. According to different surveys, only 35.5% of Bulgarians have basic digital skills. Better look at the progress and potential, because even though it is below the EU’s target, 9 years ago the number was way smaller (18%).

Developer availability

The overall population is 6.4 million, so don’t expect a large number of skilled techies. The local tech community is compact and concentrated.

The country’s CS departments and engineering schools feed both product companies and outsourcing shops. Employer-led academies mean recruiters can source engineers familiar with enterprise stacks and product lifecycles straight out of training.

Why this matters: Bulgaria gives you a concentrated seniors in Sofia for enterprise-grade work and regional benches you can scale into without the premium of larger CEE markets.

Average rates

Bulgaria’s tech is growing its share in GDP, but still has delectable rates, lower than in Poland, but slightly higher than in Ukraine. All depends on seniority and stack:

Junior: ~USD 20 - USD 30/hr

Senior/Architect: ~USD 50 - USD 80+/hr

Language and communication

Bulgaria ranks 16th on EF’s English Proficiency Index, with a “very high” score in Sofia, the capital.

PMs and senior engineers typically use English, written deliverables and sprint artifacts are usually English-first.

Time-zone fit

Bulgaria’s EET/EEST gives near-full overlap with Central and Eastern European customers and good partial overlap with Western Europe. For US clients, the common move is the follow-the-sun model.

Tech strengths and specializations

Enterprise R&D and developer tools: Bulgaria hosts major product R&D centers — Progress (Telerik/Kendo UI) and VMware historically operated large engineering centers in Sofia.

UI components: This stems from the previous point. The mentioned companies seeded local expertise in UI libraries, middleware, and virtualization/cloud tooling. The most popular languages are JavaScript, C#, Python, SQL, PHP, and .NET.

Enterprise apps and SAP ecosystems: SAP Labs has an office in Sofia, so rest assured you’ll find SAP devs and localized R&D for enterprise modules and integrations.

Why companies outsource here:

Legal clarity (GDPR/GDPR-aligned contracts) makes procurement and IP protection straightforward

Enterprise-grade engineering at good value

Startup pipeline and R&D centers of global giants

Challenges and risks

Concentration risk: Sofia concentrates most senior talent. Scaling large teams often requires multi-city sourcing or multi-country supplementation.

Employer churn after M&A: Broadcom’s acquisition of VMware triggered major cuts globally and locally, which temporarily affected hiring pools and vendor stability.

10. Argentina

Being listed among the best countries for outsourcing software development, Argentina aims to be a global leader. And the country has its legs, to be honest. Here is why.

Developer availability

With about 120,000 software developers and 20,000 IT graduates every year, Argentinian IT services are expected to grow and hit USD 3.5B.

We can’t help mentioning the government support. The National Plan for Science, Technology, and Innovation 2030 is focused on real R&D centers, cloud, and AI. As of 2023, the fiber optic network covered 33,000+ km with 85 percent of the fiber lit.

US companies already account for nearly 60% of Argentina’s IT export demand, proving that there is trust and traction.

Average rates

The Argentine currency can fluctuate significantly against the dollar even within a single month. But expect near following rates:

Junior developers (0-1 year): USD 18/hour.

Mid-level developers (1-4 years): USD 25/hour.

Senior developers (5+ years): USD 45/hour.

The figures represent the median rates across the industry.

Language and communication

Many Argentine developers speak fluently, so you won’t encounter language barriers. Argentina ranks 28th out of 116 countries in the EF EPI list. This is the second-best position in Latin America, by the way.

Time zone fit

US clients: Just perfect. UTC -3 provides broad overlap with US East Coast working hours.

EU clients: Still workable for async workflows and planned checkpoints.

Tech strengths and specializations

Product and digital commerce: Mercado Libre (regional e-commerce/fintech giant) and Globant (software services scale-up founded in Argentina) are two of the strongest signals that Argentina produces product-minded engineers able to run consumer-grade platforms at scale. These companies create local talent that then spins into startups and boutique vendors.

AI/data engineering: growing clusters around MLOps and NLP driven by startups and R&D teams inside larger product companies.

Mobile and front-end: strong UX and mobile engineering capacity coming out of consumer product hubs in Buenos Aires and Cordoba.

Why companies outsource here:

Nearshore overlap with the US

Product-oriented professionals, which basically means a higher chance of finding engineers who think in metrics, A/B tests, and customer journeys

Strong English and cultural fit for North American teams

Challenges and risks

Macro volatility and currency risk: Argentine peso inflation remains high. Contracts can include escalation clauses or USD pegs to protect purchasing power and budget stability. Use FX-clauses in multi-year contracts and prefer USD-indexed agreements.

High demand for AI, data, and fintech roles: Here, you have higher chances of finding an appropriate machine learning engineer or blockchain developer. Yet, rates for specialized roles are typically 20% higher.

Hire software developers in Argentina

Comparison across all 10 top software outsourcing countries

You’ve skipped right to this comprehensive table, haven’t you? Productive move, we’ve compiled everything here exactly for this reason.

Country

Avg hourly rate (USD)

Talent pool

Global position in 2024 EF EPI ranking (English proficiency)

Time zone

Specialization

Fintech, AI and cloud, cybersecurity

BFSI, e-commerce, AI/ML, BPM

AI/ML, cybersecurity, fintech, embedded

Cybersecurity, cloud, automation / RPA

AI/ML, e-commerce, embedded systems

E-commerce, AI/cloud, logistics

Conclusion

We are not going to discover America — there is no single best country to outsource software development.

So, instead of fluffing around, we compiled an information-rich article and built a comprehensive table so that you can quickly scan it.

In case you are on the fence about software development outsourcing, contact the Devico team. Together, we’ll find the most relevant solution for you.