Metaphorically, technology is the engine driving innovation, and fintech is the vehicle. Over the past decade, fintech has undergone a monumental transformation, reshaping the way we manage our finances, invest, and transact. Its rapid evolution has been nothing short of revolutionary, with the digital disruption of traditional financial services becoming the norm.

From neobanks like Revolut and SoFi to real estate fintech companies like Opendoor and Roofstock, the fintech industry, more than any other, has always known the financial benefits of DevOps.

That’s why its reliance on technology is undeniable, and the numbers tell the story. According to a report by Statista, the global fintech market is expected to grow to USD 294.5 billion by 2027. Such exponential growth of the field is due to the past epidemic of COVID-19 and quite the natural development of the industry. And the increased theft of sensitive data, of course. DevOps, in this case, is akin to Sancho Panza from Miguel de Cervantes’s novel — similarly, it helps the entire industry to operate safely and smoothly, easing off lives of millions.

Fintech is not just about technology, it's about people. It's about using technology to improve the lives of people.

Chris Dixon, general partner at Andreessen Horowitz

Have a fintech company and already thinking over entering DevOps? Consider this material, and if you have time, check the benefits of DevOps outsourcing. These articles take up to 10 minutes to run through but will save you from severe delegation mistakes.

The Fintech Landscape

Fintech, short for financial technology, is a dynamic and disruptive force that's revolutionizing the way we interact with money and financial services. The field is not limited to payments. There are other sectors where fintech appears.

Fintech Key Sectors

Payments: Here, we selected companies that are developing and offering new ways to pay for goods and services. If the company helps you to receive anything for money and the seller to receive money for their thing, that’s a fintech company from the notional payment sector. We’re sure you used them: mobile wallets, digital payments, and cryptocurrency.

Lending: Here, collected companies that are providing lending products. For example, peer-to-peer lending, crowdfunding, and marketplace lending.

Insurance: Companies from this sector combine digital platforms, data analytics, artificial intelligence, and other technological tools to enhance the insurance process, improve customer experience, and offer tailored and efficient insurance products. For example, on-demand insurance and microinsurance. You might have encountered them: Lemonade or Insurify.

Wealth management: Robo-advisors or micro-investing platforms — such companies are from this sector. SoFi, Robinhood, and Betterment are examples of such companies.

Shares of Each Sector in the Total Fintech Industry

According to Statista, we’ve got the following ramification of sectors (shares in the total industry):

The remarkable growth of fintech can be attributed to the escalating demand for innovative and safe financial solutions.

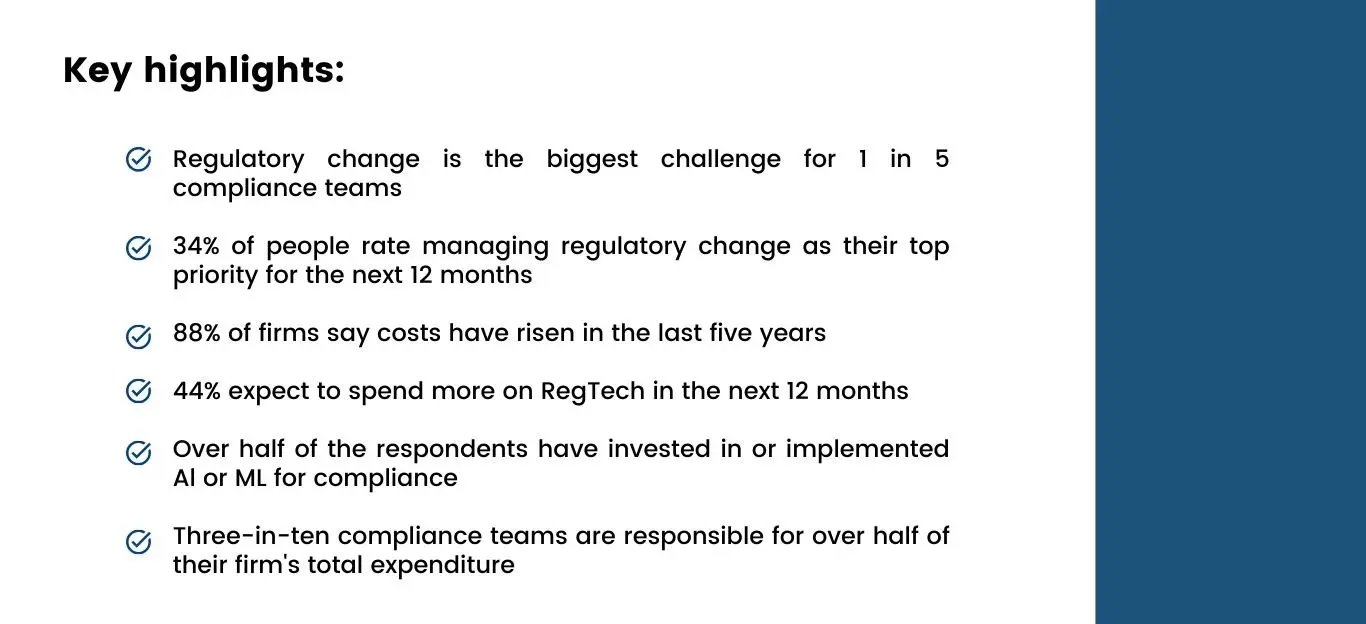

Challenges Fintech Companies Face

The path of fintech innovation is not without its challenges, particularly in ensuring seamless services while navigating a complex and stringent regulatory environment. So, what are the most common challenges?

Regulatory compliance: Fintech companies must comply with a strict set of regulations. The most known standard in the industry is ISO 27001, a globally recognized standard for information security management systems (ISMS). This regulation describes the approach to financial data management, including its confidentiality, integrity, and availability.

Security: Fintech companies need to protect their customers' data and financial assets from cyberattacks. This is a major challenge, given the ever-increasing sophistication of cybercriminals.

Competition: Fintech companies face competition from both traditional financial institutions and other fintech companies. This competition can make it difficult for fintech companies to stand out from the crowd and attract customers.

This is where DevOps enters the picture, as it's well-equipped to tackle these hurdles. DevOps practices ensure faster and more reliable delivery of financial services while maintaining compliance with stringent regulations. DevOps can help fintech companies to enhance security by automating and streamlining their security processes.

How to Overcome Fintech-DevOps Integration Challenges

Let’s face it, DevOps reshapes the financial landscape. But along with it, it brings a bundle of challenges. We described some above. To overcome these problems and take over the position of niche ruler, fintech companies must master the basics moves: collaboration between departments/teams, modernizing infrastructure, and managing security concerns. And the last one is probably the most important.

Addressing Security and Compliance Concerns

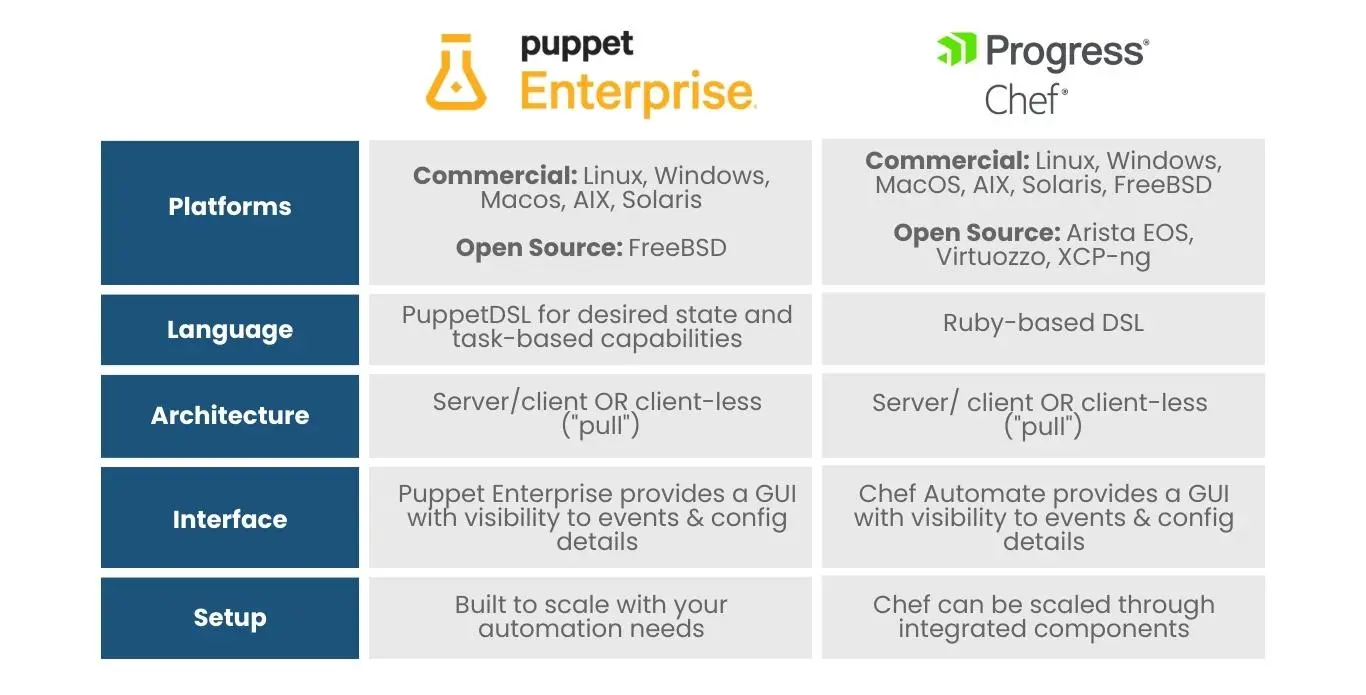

Keep an eye on security — this issue must be a top priority. Use configuration management platforms like Chef and Puppet. They offer automated configuration management and compliance monitoring. These tools help ensure that every piece of infrastructure and every line of code adheres to the stringent regulatory standards required by the industry authorities without manual intervention. This not only safeguards sensitive financial data but also mitigates potential regulatory fines.

Two most popular DevOps compliance tools: Comparative table

Foster Collaboration to Embrace Cultural Shift

Your team is King. So is collaboration — Queen. Fintech companies often opt for Agile or Scrum methodologies, which encourage cross-functional teams to work together. This is where tools like Jira come into play. They help to manage and track tasks within separate projects, ensuring that devs and project managers, for example, are on the same page. Another important point is the transparency of the teamwork. Utilize regular meetings and open communication channels, they are critical in maintaining transparency.

Strategies for Managing Legacy Systems and Modernizing Infrastructure

Outdated software, aka legacy systems, can strictly hold back fintech companies from sailing into the future. But there is a solution — containerization and microservices architecture. Consider Docker and Kubernetes, they enable the enclosing of legacy applications into containers, making them more manageable and portable.

That’s another evidence of why Bezos and other tech geniuses are so rich, they noticed the full potential of cloud and web services before they became mainstream. Amazon Web Services (AWS) and Microsoft Azure can modernize an infrastructure and play a significant role in your software development spectacle.

Other tools for managing legacy systems and modernizing infrastructure:

Containerization platforms: Kubernetes, LXC, Docker — engines and orchestrators, such tools can be used to manage legacy systems and modern infrastructure.

Infrastructure as code (IaC) tools: Ansible, Terraform, and Chef are popular IaC tools that allow DevOps teams to set up infrastructure resources (for example, load balancers, virtual machines, and networks), using descriptive models and languages.

Cloud computing platforms: Mentioned Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are here to help.

In general, the modernization approach ensures scalability and agility while maintaining operations. Take a glance at PayPal. Former Musk’s company transformed its legacy infrastructure with Kubernetes and saw a 35% reduction in costs and a 40% improvement in infrastructure efficiency.

Need for Speed. Need for DevOps

Want to stay competitive and meet the demands of the modern financial landscape? You’d better adopt the best approaches in the software development industry. And DevOps, a portmanteau of "development" and "operations," is like a cherry at the top of the soft dev cake.

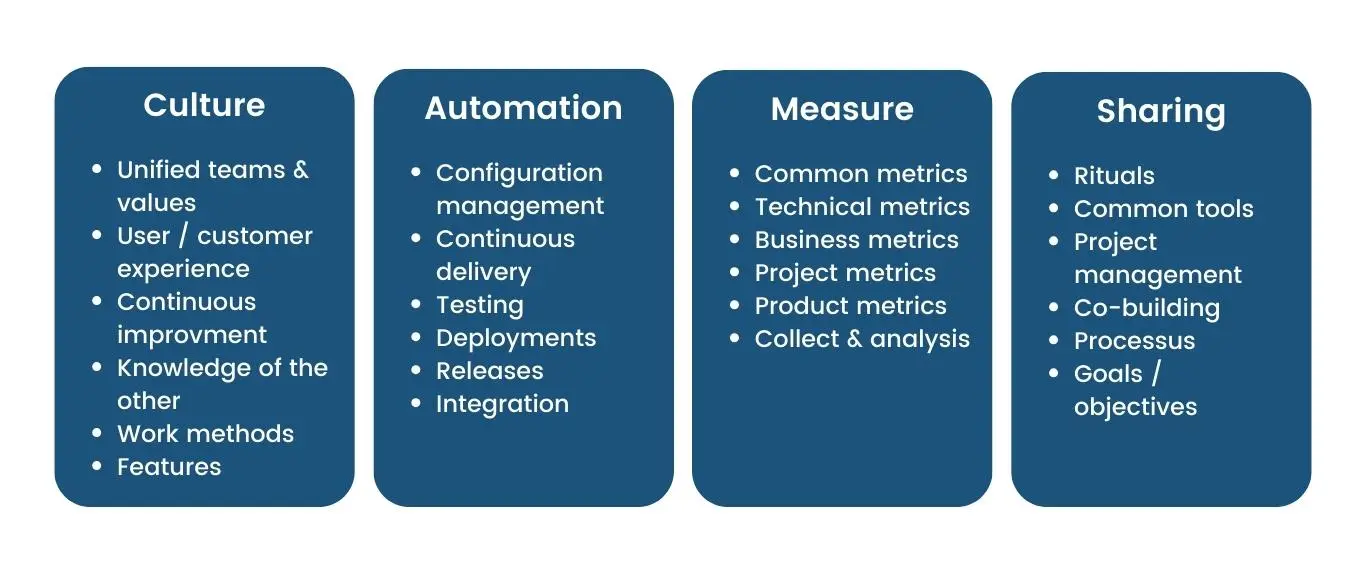

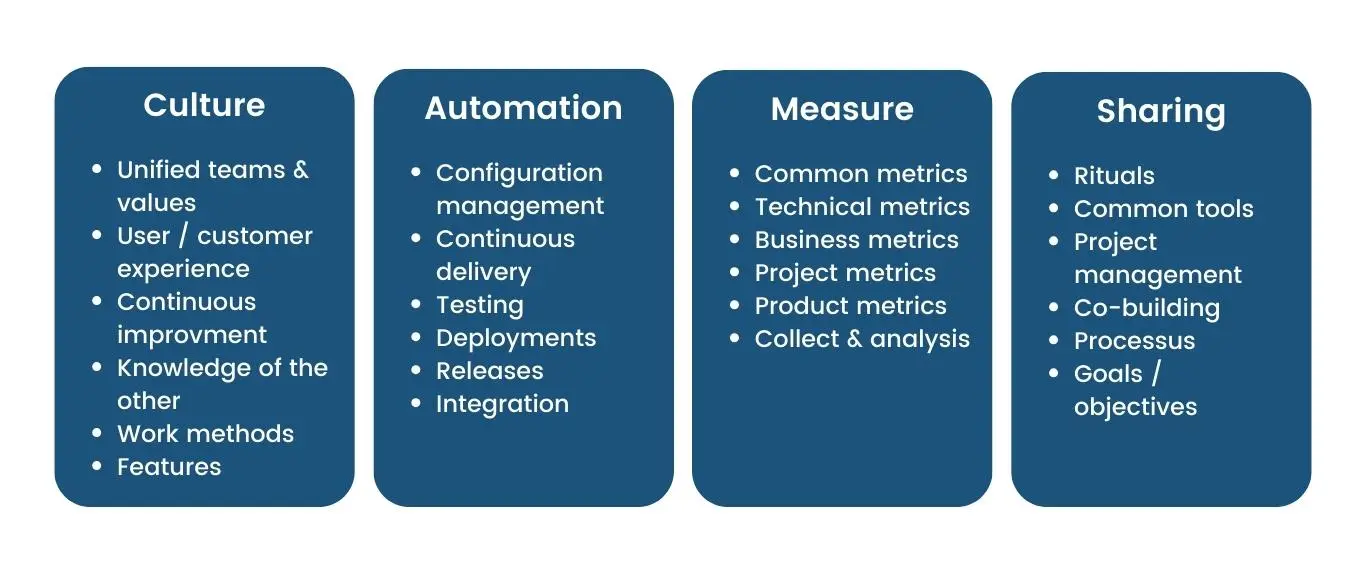

Four Key DevOps Pillars

Collaboration: DevOps fosters a culture of cooperation. Not only between development and operations teams. It encourages many departments to work together, share responsibilities, and streamline processes. Even if you outsource DevOps, this move will have an impact.

Automation: Automate anything you can reach — this phrase could be a motto of DevOps. At least, it’s one of its pillars, as automating manual and repetitive tasks in the soft dev lifecycle reduces errors and accelerates deployment.

Measurement: DevOps promotes a data-driven approach. But note: quality data. Such a remark has become a cornerstone for the past years as the data amount is continuously growing and the quality is becoming even more essential. It emphasizes the collection and analysis of key performance metrics to identify areas for improvement continually.

Sharing: Sharing knowledge, practices, and tools is a fundamental DevOps tenet. Don’t limit yourself to a standard cross-functional team. Make up your own approach to knowledge sharing. For example, you can reinvent TED and come up with a similar internal event in your next teambuilding.

Why Should Fintech Companies Adopt DevOps?

Firstly, DevOps accelerates time-to-market, a critical factor in the competitive fintech landscape. Automates tasks like testing and deployment so that companies can roll out new features and updates faster. This agility ensures they remain among the most progressive companies.

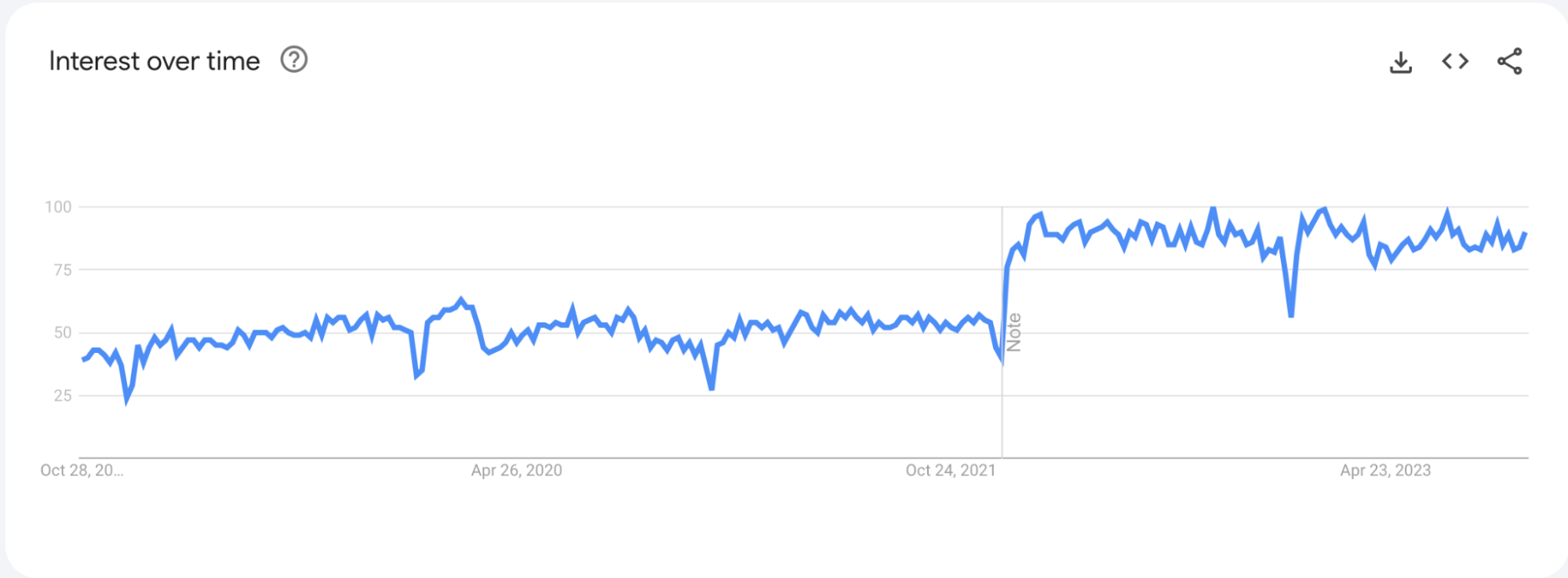

Over 5 years, interest in DevOps increased drastically

Secondly, DevOps enhances security. By integrating security into the development process from the outset, fintech companies can identify and rectify vulnerabilities in real time. This proactive approach reduces the risk of data breaches and protects sensitive financial information. For example, Revolut (like other big-cheese fintech companies) regularly launched Bug Bounty contests. This allows them to find vulnerabilities at a much lower cost than a data breach, for example (just recall the recent MOVEit data breach that affected over 60 million individuals and size up possible consequences).

Last but not least, DevOps improves customer experiences. With faster updates and reduced downtime, fintech companies can offer a more reliable and responsive service to their customers. This yields higher CSAT and other “perks” in your relationship with customers.

Examples Section

General example first.

Want to achieve faster and more reliable delivery of new features and updates to customers? Try to automate the software release process then. By utilizing a Continuous Integration (CI) tool, you can automate the building and testing of new code. The CI tool can be set up to automatically run tests whenever new code is committed to the code repository, ensuring that the code is always tested before being deployed to production.

Then, employ a Continuous Delivery (CD) tool to automate the deployment of new code to production. The CD tool is configured to deploy new code automatically to production once it has passed all of the tests. This guarantees that new features and updates are seamlessly rolled out to customers, maintaining high levels of reliability and agility.

So let’s take a look at a couple of real-life examples.

DevOps culture allowed Stripe to reduce the time taken for development and deployment, ensuring that new payment features are launched swiftly and securely. We’re sure it’s not necessary to introduce Stripe.

Another standout is Robinhood, the stock trading platform. By adopting DevOps, Robinhood ensures that its trading platform is available 24/7, even during market volatility. They can respond to high volumes of trading seamlessly, providing an exceptional experience for their users.

DevOps Implementation in Fintech

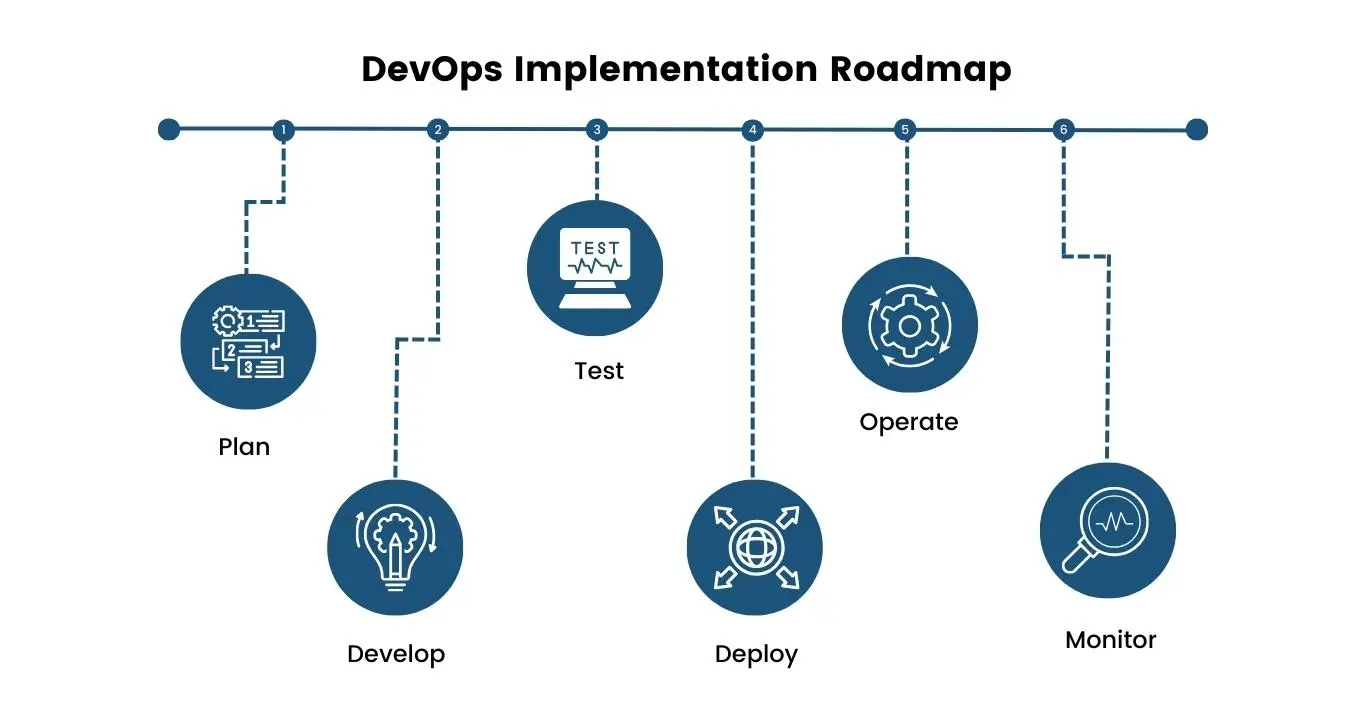

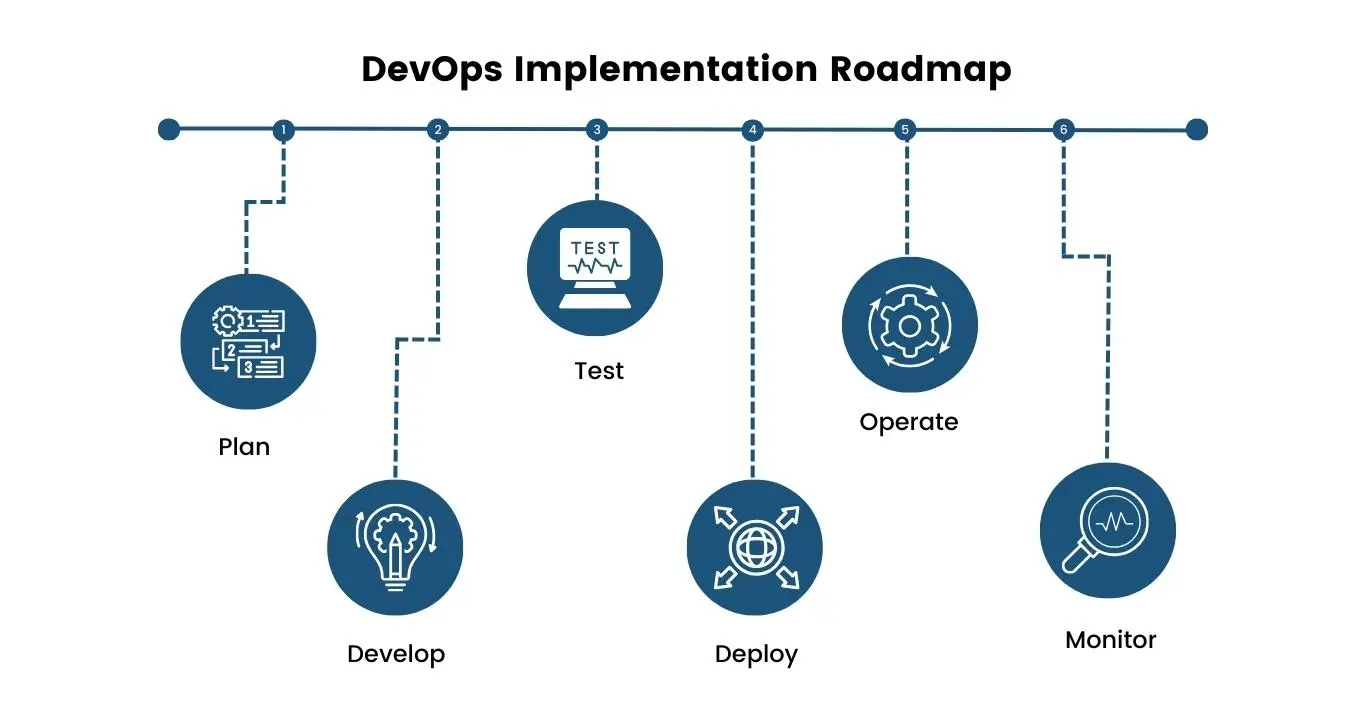

Imagine a large pocket watch. Vintage and antique. It 100% has to have at least one big gear. There should be up to six cogs in that gear. If one of them breaks, the watch won't run. So, each of the next 6 phases of DevOps is a cog.

Plan: The team members define their objectives, outline the scope of their projects, and create a roadmap for development. If you are an alien to DevOps metrics and KPIs, check our article here.

Develop: Actual stage of creating the software. The fintech team there is actually a team of devs who writes and designs the components that will become the final product.

Test: Quality assurance is paramount in fintech, and this phase mirrors the rigorous auditing and validation processes in the financial sector. Fintech teams test their code and features, ensuring that they function correctly and securely.

Deploy: Deployment is the release of the software to the production environment. In fintech, it's equivalent to launching a new financial product or service into the market, with all the compliance and security considerations that this entails.

Operate: This phase encompasses the day-to-day operation of the software. Just as financial systems require constant monitoring, fintech applications need ongoing management, including troubleshooting and scaling.

Monitor: Monitoring is akin to keeping an eagle eye on financial markets. It involves tracking the software's performance and ensuring that it meets security, compliance, and user experience benchmarks.

No Probs: Tailoring DevOps for Fintech

Fintech operates within a highly regulated environment, with stringent standards for data security and risk management. Specific regulations such as the Payment Card Industry Data Security Standard (PCI DSS), ISO 27001, and the General Data Protection Regulation (GDPR) place strict requirements on how financial data is handled and protected.

And it’s obvious that DevOps practices, in this case, must meet these standards. For example, encryption is a critical element in data security, and DevOps teams must ensure that encryption is applied consistently throughout the development process. Similarly, continuous monitoring is essential to maintain compliance with various financial regulations. Conducting regular security assessments, vulnerability scanning, and penetration testing to identify and mitigate risks are the main moves in this direction.

The Power of Cross-Functional Teams and Communication

Square is a fintech company renowned for its point-of-sale and payment processing solutions. Square's success can be attributed, in part, to its commitment to cross-functional collaboration and communication.

Its engineering and operations teams work closely together, collaborating throughout the DevOps lifecycle. They have implemented real-time monitoring and automated alerting, allowing both teams to quickly respond to any issues. For example, during almost every holiday season, Square's cross-functional teams ensure that their systems operate without a hitch, despite increased transaction volumes.

This collaboration not only prevented potential financial losses due to service disruptions but also enhanced the customer experience, strengthening Square's position in the highly competitive fintech market. It underscores the importance of effective cross-functional teams and communication in achieving DevOps success, particularly in fintech, where reliability and security are paramount.

DevOps Implementation in Fintech: Best Practices

Speed and reliability in the Fintech industry are paramount, and Continuous Integration (CI) and Continuous Deployment (CD) are indispensable. Adyen, for instance, has mastered the art of CI/CD by automating code integration and deployment, ensuring new features are quickly delivered to customers without compromising system stability.

Don’t forget that the Fintech sector is tightly regulated, and compliance testing is critical. CI/CD pipelines are designed to include compliance checks, guaranteeing that all regulatory requirements are met before the code reaches production.

Infrastructure as Code (IaC) and its Role in Maintaining Consistent Environments

Previously we said that team collaboration is king. Well, consistency is king too. In a sector where any discrepancy can have far-reaching consequences, Infrastructure as Code (IaC) is a linchpin, enabling the automated provisioning and management of infrastructure. Look at Square leveraging IaC through tools like Terraform to maintain uniformity across development, testing, and production environments. This consistency not only boosts efficiency but also simplifies compliance audits, a critical consideration in fintech.

Monitoring, Logging, and Performance Optimization

Real-time monitoring and robust logging are the lifeline of operations. For this reason, there are tools like Splunk and Prometheus. They help to monitor system performance, detect anomalies, and proactively address issues. Continuous performance optimization is exemplified by Stripe, which regularly fine-tunes its systems to handle surges in transaction volumes without degradation in service quality.

Implementing Automation in Testing, Deployment, and Scaling

Want to get to know the secret sauce behind the agility and reliability of fintech systems? Au-to-ma-tion. PayPal has pioneered automation in testing, employing tools like Selenium and Jenkins to ensure comprehensive and repeatable tests.

Automated deployment through pipelines ensures that new features reach customers swiftly without manual intervention. Scaling is another aspect where fintech firms lead; Robinhood, for instance, leverages auto-scaling to dynamically adapt to market fluctuations, allowing them to serve customers even during high trading volumes.

The Future of DevOps in Fintech

Let’s face it, we’re all using digital payments now. For this reason, the Fintech industry will definitely evolve and thrive. And that’s why fintech companies are increasingly adopting DevOps practices — they want to release new features and updates more quickly and reliably, they want to improve the customer experience and reduce costs.

Evolution of DevOps Practices in Fintech: What to Expect

The future of DevOps in fintech is marked by an increasing focus on security and compliance automation. Predictions indicate that DevSecOps will become the norm, with security integrated into every phase of the DevOps lifecycle. As regulatory standards evolve, compliance-as-code will gain prominence, ensuring fintech companies remain resilient in the face of stringent regulations.

Role of Emerging Technologies (AI, Blockchain, Cloud Computing)

Well, modern time shows that any predictions cost an arm and a leg to prognosists. But we’ll try to be accurate while daring to make a prediction.

Emerging technologies like AI, blockchain, and cloud computing will play pivotal roles in shaping the DevOps-Fintech synergy. AI-powered analytics will enhance monitoring and predictive maintenance, ensuring systems are always at peak performance.

Blockchain will be leveraged for secure and transparent transactions or data operations.

Cloud computing will provide the scalability and flexibility that fintech companies require to meet the ever-increasing demands of the market.

The combination of these technologies will pave the way for the development of novel financial services and solutions, enabling Fintech to remain one of the most innovative industries.

To sum it up

DevOps plays the architect of innovation and the guardian of reliability role, in the sense that the financial benefits of DevOps have more weight than the challenges this approach brings to your company. The most clear-cut and valuable part of any material is the real-life examples. Look up to companies like Square, Stripe, Adyen, and PayPal if you want to gain ground in the Fintech industry. Such companies have illustrated that DevOps is a truly transformative approach that powers fintech's growth. It streamlines processes, ensures security and compliance, and delivers cutting-edge solutions at a pace that can't be matched.

According to Statista, the global fintech market is expected to grow to USD 294.5 billion by 2027. This growth is being driven by a number of factors. For example, leveraging AI technologies and cloud computing. DevSecOps also takes center stage, emerging technologies like AI and blockchain revolutionize operations, and the demand for skilled DevOps professionals soars, underscoring the pivotal role DevOps will play in shaping the financial industry.

The future is clear: there is already a need for DevOps in the Fintech industry will continue to evolve hand in hand. Continuous learning and adaptation will be our compass, guiding us as we harness the synergy between these two powerhouses. Embracing change and staying ahead of the curve will be the modus operandi for fintech professionals.