The fintech industry is exploding, with thousands of new companies emerging each year. In 2024 alone, nearly 30,000 fintech companies are operating globally, up from just over 26,000 in 2023.

Such a quick development of this industry causes fierce competition. Consumers are becoming spoiled with such an abundance of different products and services, and their demands are constantly increasing.

Deploying cutting-edge technologies can help a business keep up with the ever-growing demands of the target audience and prevent a company from falling behind competitors.

What technologies can you use to upgrade your financial technology business? How to achieve digital transformation step by step? You will find the ultimate answers to these essential questions in this article.

Seamless digital transformation with 30% faster time to market and budget savings of up to 20%

Understanding the basics and importance of digital transformation in fintech

The fintech industry continues to experience unprecedented growth year after year. According to the Statista survey, there are more than 3 billion customers in this niche worldwide, and this number is expected to have grown to 4.8 billion by 2028.

Advanced financial technologies are gradually replacing traditional services. For instance, one of the latest researches by the American Bankers Association has shown that 71% of users prefer managing their financial affairs online (48% of them — with the help of mobile apps), while only 9% of clients would rather go to a physical bank branch.

In addition, more and more people around the world are favoring cryptocurrencies over traditional currencies as payment and investment tools. It is proven by the Forbes statistics, which state that the capitalization of the crypto market has exceeded 2.5 trillion dollars.

As is well-known, demand creates supply. Such a keen interest in modern fintech instruments and services from users from all over the world generates a constant growth of supply in this sphere.

Every year, plenty of new companies emerge, while the existing ones introduce numerous innovations to keep their regular customers and attract new ones.

In the face of such rapid growth, it is crucial to keep up with the competition to avoid being left on the sidelines of the market. To excel in this constant race you need to keep on improving all the time. And digital transformation of your business is certainly the solution that can help you in this.

The most crucial points of digital transformation in fintech

Innovative solutions

Modern companies never cease to amaze users. Hundreds of new applications and online services appear every month. Don't waste your time. You can win a lot of new customers by offering them something new. Develop an application for your company’s clients, payment service, e-wallet, or other solution that will be interesting for modern consumers. You can also add more features to your existing apps to expand your target audience.

Customer service enhancing

A modern fintech business should have a customer-centric approach as there is a shocking level of competition in this industry. If your products and services don’t meet consumers’ needs and demands, they will just choose your competitors. To prevent this, do whatever it takes to make your products and services as convenient and personalized as possible. Some emerging technologies like AI and ML-based solutions can help you with this. Using them, you can, for example, track user behavior and give personalized offers to your clients.

Optimization and automation of business processes

Optimizing and automating your business processes can bring you an abundance of benefits, such as:

Improving customer experience. Automating some processes makes interaction with customers faster, and therefore, more comfortable for them.

Taking operational accuracy to the next level. Process automation minimizes the risk of human error.

Accelerating the employees’ productivity. You can reach it by reducing the amount of routine work with the help of automating it.

Data analytics

Data analytics is a crucial element of developing business in any area, especially in the financial technology niche. State-of-the-art big data technologies bring a multitude of advantages. They give an opportunity to:

Optimize business processes. Data analytics allows looking over staff productivity and workflow efficiency to find the points that can be improved or automatized to boost performance.

Enhance customer experience with the help of personalization. By collecting data about your customers and their behavior and analyzing it, you can give your clients offers that are as relevant to their interests and needs as possible.

Improve the effectiveness of anti-fraud efforts. AI-based technologies can "memorize" typical customer behavior and recognize anomalous transactions.

Simplify and speed up decision-making. For example, it is possible to assess a customer's creditworthiness automatically. Data analytics can help define the solvency of a potential creditor and assess the risks associated with providing this service to him/her.

Digital transformation can make data analytics easier and more effective. Innovative big data technologies give an opportunity to collect, analyze, and process huge amounts of information with high accuracy and speed.

Security measures

Safety is a crucial point in the fintech industry as this sphere is associated with clients’ personal data which is a tidbit for fraudsters. The use of digital innovation can take security to the next level. With the help of modern technologies like advanced encryption solutions, it is possible to:

Reliably protect a website or application from hacker attacks.

Make cloud servers and APIs sound.

Make authorization, authentification, and identification processes safe.

Secure clients’ transactions.

Fintech partnerships

Building strategic relationships with partners like regulators, technology providers, or fintech industry associations opens you up to a multitude of benefits, such as:

Increasing brand awareness.

Regulatory compliance

The regulatory environment for finance institutions is complex and constantly developing. The General Data Protection Regulation (GDPR) in Europe and the Dodd-Frank Act in the US are considered to be classical regulations in this area. But they are far from the only ones in existence. New laws are constantly appearing, and old laws are being updated. Modern technologies, especially AI- and ML-based, make it possible to monitor regulations more effectively and comply with them more accurately.

The stages of digital transformation of a fintech

Have you already decided that your business can't do without innovative technologies? This is a great resolution! But how can you carry out a digital transformation? Below, we describe each step on the way to improvement through innovation in detail.

Stage 1: The starting point and goals

You need to clearly define the objectives of digital transformation to achieve the best results.

While setting goals, it is essential to consider many individual factors, such as:

The current state of your company.

Strength and weaknesses of your products, services, and business processes.

The points you would like to improve.

The overall business strategy of your company.

Short-term and long-term goals of your business.

The current state of the market, and competitors' offers.

In order to dive deeply into all the subtleties and nuances of making a high-quality analysis, it is advisable to resort to the services of professional business analysts.

Stage 2: Planning tasks, setting priorities, and developing a roadmap

When a company has already defined its goals, it is needed to clearly define the methods of achieving them. In this phase, the following is made:

The result of this phase is a roadmap. This is a document that explicitly depicts your project plan.

To ensure that you are not disappointed with the outcome, it is needed to plan everything thoroughly before you start the process of implementing innovations in your business. However, it is important to remain flexible. Your plan should not be too rigid so that it can adjust to changing conditions.

During prioritization, it is crucial to consider the importance and urgency of every task. For example, the most prioritized tasks may be those:

Without which even an MVP (minimum viable product) version of the project cannot be launched.

That will have the maximum impact on the final result. For example, it is more appropriate to implement features that are of interest to more users first, and only then those that are in less demand.

That can bring maximum results at minimum cost and in a short time.

Stage 3: Improving customer experience

Customer experience is the key to winning the competition. According to Zendesk research, more than 50 percent of users are going to choose the competitors right after their first unsatisfactory experience with a certain company.

So, not to lose your clients, do whatever it takes to continuously upgrade customer experience. Digital transformation can become the best assistant in doing this.

What modern technologies can help you enhance customer experience and how? Below are some examples.

Service personalization

Modern technologies give an opportunity to collect and analyze clients’ data and track customer behavior. This information helps you give personalized recommendations to users and make their experience with your products and services as comfortable as possible.

Seamless transactions

Speed and security of transactions are customers’ most important criteria when choosing financial institutions. Provide the clients with the opportunity to manage their financial affairs in a few clicks, and they will be even more satisfied with your services.

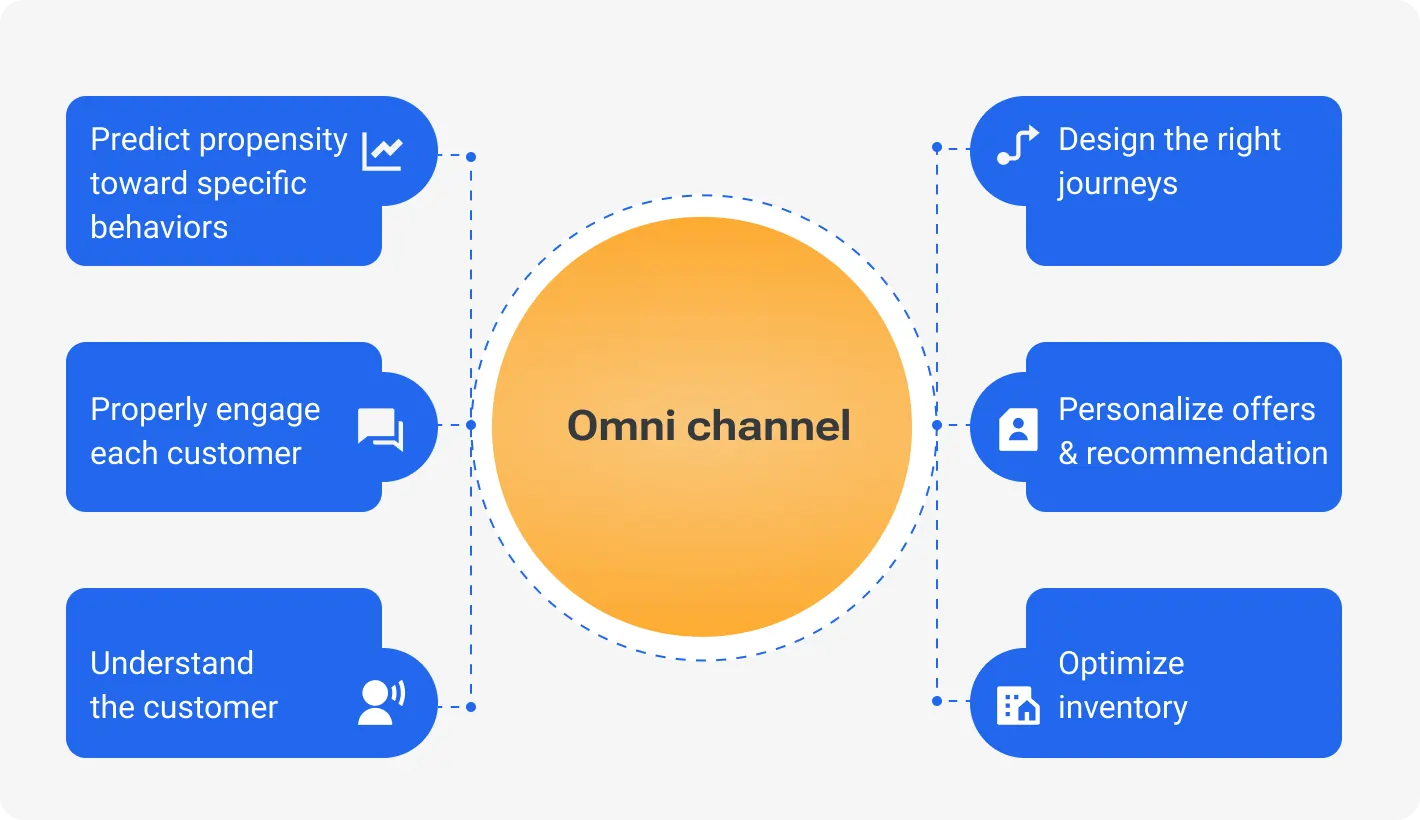

Omnichannel communication

Today's users want to stay connected to their favorite brands at all times. Allow your customers to have constant access to your services and contact you in any convenient way.

A modern company should have both a website and a mobile app.

It's also a good idea to give users the ability to contact you via phone, messengers, email, and website chat. In addition, a company's presence on social media will also benefit the brand.

AI/ML-based technologies will help to understand what methods of communication are preferred by different customers based on their behavior. This will make your interaction with them as comfortable as possible.

Some of the interactions with the customers can be automated through modern technologies, for instance, chatbots. And integration with a CRM system can help to ensure that customer data from different channels is not lost or mixed up.

Stage 4: Optimizing workflow and automating processes

The latest technologies make it possible to optimize business processes, speed up task completion, and, consequently, boost productivity.

Modern technology allows the automation of repetitive tasks, especially if they are based on clear rules. It will bring a lot of benefits to your workflow:

Performing a huge number of routine tasks quickly.

Minimizing a human factor and related errors.

Freeing employees from routine tasks, giving them time for more important and global things that require human creativity and analysis.

For optimizing workflow, it is possible to use:

advanced data analytics technologies;

According to McKinsey research, 88% of heads of financial and insurance companies state that they started to use automation and AI technologies even more actively since 2020. To keep up with your competitors, implement digital innovation in your business as well.

Stage 5: Utilizing cutting-edge technologies

Cloud technology

Cloud technology allows storing data online instead of doing it on a physical hard drive. It is a great way to:

prevent the loss of data;

fasten recovery after force majeure;

make your business more flexible;

improve staff productivity.

Blockchain

This is a decentralized base of data that consists of a constantly increasing number of records (“blocks”) linked to each other with the help of cryptography.

Blockchain is the future of the fintech industry. According to the research made in 2023, the global blockchain market capitalization was 2.2 billion dollars in 2022 and is expected to have grown to 93.3 billion dollars by 2032.

Multiple companies around the world choose to use blockchain technology thanks to its numerous advantages, such as:

Transparent transactions. The data is distributed across multiple storages, and everyone with access can see exactly the same information, as it is recorded in an unchangeable form. It contains the date and time of transactions, which makes it easy to keep track of them as well as fight fraud.

Advanced level of security. For each transaction, the blockchain generates an unchangeable record with strong encryption. Moreover, the data in blockchain is distributed across a network of computers. As the information is not stored as one copy on a specific server, it is almost impossible to hack it.

Fast and cheap operation. Blockchain can be compared to a digital ledger that automatically records transaction data. Thus, this technology reduces the need for human intervention and “paperwork”. This speeds up work, optimizes costs, and reduces the likelihood of human error.

Artificial intelligence and machine learning technologies

These state-of-the-art technologies open up limitless opportunities for businesses. They allow taking workflow and service to the highest level. AI and ML technologies can:

Improve personalization. With today's technology, you can automatically offer users services tailored to their interests and needs. ML and AI help collect data about customers’ behavior and automatically personalize their experience with your brand.

Advance the interaction with customers. You can use chatbots and other AI-based automatic technologies to make your communication with clients faster and more effective.

Increase the effectiveness of fraud prevention. ML technologies help to collect and “memorize” the data about customers and their behavior. And then, AI algorithms can automatically recognize suspicious practices that may indicate fraud.

Evaluate the risks more effectively. ML/AI-based technologies have a high potential for prediction. Based on "learned" information, they can forecast users' future behavior, their solvency, as well as other factors that help to estimate the risks.

What really works when it comes to digital and AI transformations?

Stage 6: Enhancing security and ensuring compliance with regulations

Safety is the most crucial criterion for the selection of financial organizations by clients. Since the use of financial instruments is closely related to sharing private information, users want to have strong guarantees of the security of their personal data and funds.

Security lapses can become very costly for fintech companies. They can lead to massive losses and a reduction in the number of customers. For instance, according to Statista, the average cost of data leakage in the USA was 4.45 million dollars as of 2023.

The introduction of modern technologies to improve safety will help:

Reduce vulnerability to hacker attacks.

Protect sensitive data from falling into the hands of malicious parties.

More effectively identify fraudulent activity.

Identify behavior that may be indicative of money laundering.

To achieve these goals, it is possible to utilize such solutions as innovative ways of data encryption, blockchain, and AI/ML-based algorithms.

And, of course, no finance company should ever forget to comply with the regulations. Governments and regulators worldwide are constantly implementing new laws and rules to prevent crime in this industry and protect the rights of consumers. To easily and quickly adjust to different regulations, AI/ML-based technologies can be utilized.

Stage 7: Developing and supporting the innovation culture

The world does not stand still, and the constant implementation of different new technologies is inevitable. For your company to continually evolve, it's important to create and nurture a culture of innovation. Here are some ways of how to do this:

Create a strategic development plan. All your improvement efforts should correspond to the global goals of your company. Document your objectives and familiarize all employees with what your company is striving for and the direction your business is moving in.

Train staff on working with new technologies. Regularly organize in-house training or send employees to external courses. Encourage employees’ development by offsetting the cost of training and reviewing salaries as their competencies grow.

Encourage experimentation. Be open to discussing employees’ ideas and trying something new. Hold brainstorming sessions where everyone can suggest their options for improvements and reward participants for the best suggestions.

How digital innovation is used in fintech: An exciting real-life example

One of the most prominent examples of using cutting-edge technologies in the fintech industry is the experience of the world-known company called Stripe. Its goal was to provide businesses with a solution to quickly, easily, and securely manage online payments, subscriptions, and other financial transactions.

How the company achieved its objective

Stripe wanted to differentiate itself from its competitors by offering a simpler integration that didn't require a lot of time and documentation. It has released a set of APIs that allow for effortless integration of payment gateways shortly.

Expanding the target audience

To interest even more customers, the company started supporting Bitcoin transactions in 2014.

Offering advanced security

In 2015, Stripe implemented ML-based technologies to more effectively recognize fraud, thereby protecting its customers.

In 2021, they added sales tax tools based on cloud technologies.

Results:

In 2016, the company hit #4 in the Forbes Cloud 100 list.

It is popular in 46 countries worldwide.

Its capitalization reached 65 billion dollars in 2024.

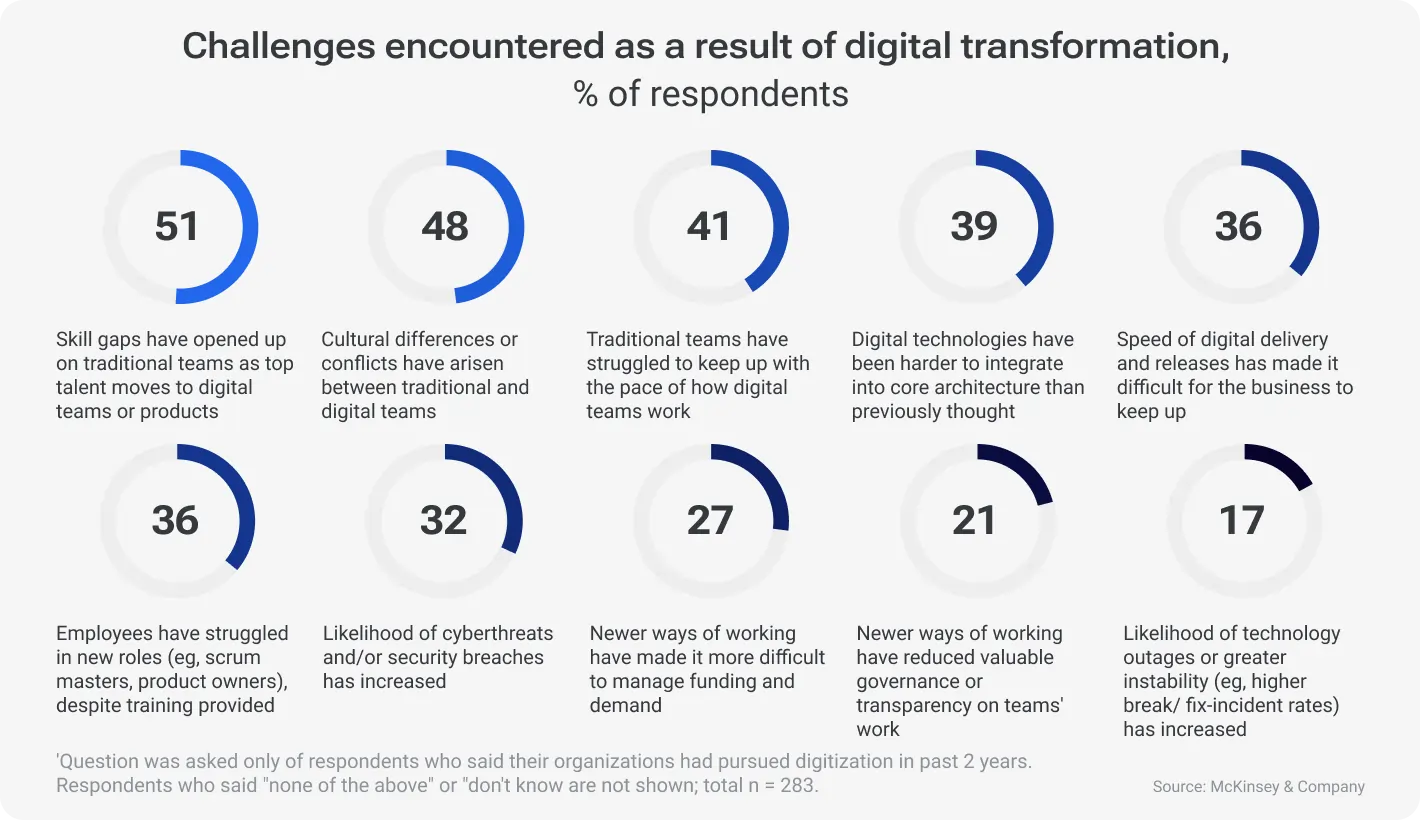

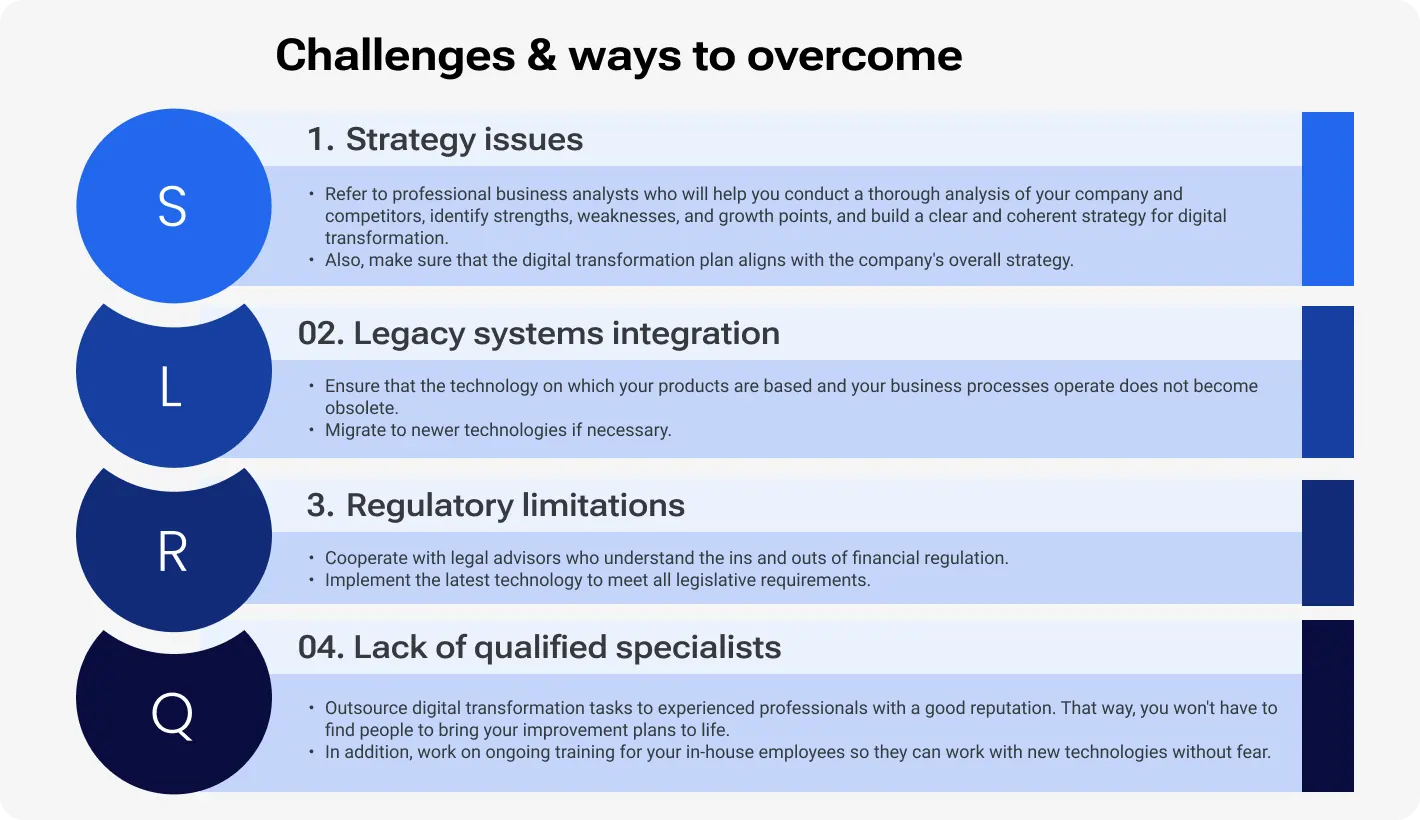

Challenges you can face during digital transformation and the best practices to avoid them

Such a useful but rather complex process as introducing new technology into a fintech business can be marred by some difficulties. Let’s look at the most common of them and the possible ways to cope with them.

The most widespread challenges

Strategy issues

Many companies are thinking about introducing emerging technologies into their workflows and products but not all of them understand how exactly they should do this. This may be the reason why some digital transformation efforts fail.

Not understanding what modern solutions are appropriate to incorporate into your business, as well as how exactly to do this, may lead to budget mismanagement and poor final results.

Legacy systems integration

Outdated technologies can be the ballast that pulls you back. They hamper further innovation and development, slow down operations, and require a large budget for support. Furthermore, many legacy systems are incapable of integration, making the data management process too complex and inconvenient.

Regulatory limitations

The world of financial technology is constrained by strict legislative frameworks, deviation from which is unacceptable. This is also complicated by the fact that regulation does not stand still: new laws are constantly being passed and old ones are being supplemented. All this can lead to difficulties and delays in the digital transformation process.

Lack of qualified specialists

A shortage of skilled professionals can make digital transformation very difficult or even impossible.

Getting the tasks of implementing new technologies done in a poor way may lead to:

schedule slippage and significant delays;

the excessive cost of debugging and support;

losses associated with the need to redo the work.

At the same time, finding true high-skilled professionals who will complete the tasks in the best way can also have its challenges. It can require a significant budget and take a lot of time.

Another stumbling block to digitally improving your business may be the inability of employees to work with new technologies, and consequently their resistance to innovation.

How to overcome the challenges

How to cope with the above-mentioned difficulties? From the table below, you will find out the best practices for this.

For more details on digital transformation challenges and the ways of dealing with them, check out another article from our blog.

Conclusion

Without continuous development, a modern fintech company cannot win the race of competition. Innovations such as process automation, big data, cloud technologies, blockchain, AI- and ML-based solutions can help to enhance customer experience, solve privacy and security issues, optimize workflow and costs, and reach many other goals.

Upgrade your products and services by setting a plan of digital transformation that aligns with your company’s values and targets, and bringing it to life step-by-step. Experienced Devico team is ready to help you with everything related to innovation implementation: from goal setting and building a roadmap to high-quality development of the solutions you need.

Book a free IT consultation with Devico specialists if you are ready to take your business to the next level using cutting-edge technologies.

Struggling to keep up with the competition due to outdated technology?